Is China taking a step ahead amid Saudi-Us row

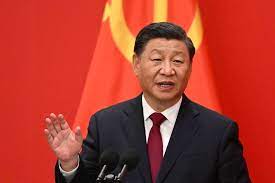

Strengthened ties between China and countries in the Middle East, with President Xi Jinping reportedly set to visit Saudi Arabia and attend summit meetings with regional leaders after securing a third term as Communist Party general secretary, have raised the prospect of China stepping in as the US pulls back from the region.

Xi’s anticipated visit was announced by Saudi Arabian Foreign Minister Prince Faisal bin Farhan after a virtual meeting with Foreign Minister Wang Yi on Thursday, but it has yet to be confirmed by Beijing.

The announcement came amid a US-Saudi oil dispute after Riyadh, a long-time security partner of Washington but also part of Beijing’s Belt and Road Initiative, led members of the Opec+ grouping of oil-producing countries to decide this month to cut oil production by a massive 2 million barrels a day in response to falling demand. That could drive petrol prices higher and create ripple effects in the US economy before midterm elections next month.

Many observers saw the decision as a slap in the face for the US amid increasing tensions between Washington and Riyadh over issues ranging from human rights to Iran’s nuclear programme. Some said deteriorating ties with Saudi Arabia could see Washington lose influence in the Middle East to China, as seen in recent interactions between Beijing and Riyadh.

High-level virtual meetings between the Chinese and Saudi Arabian foreign and energy ministers over the past week reaffirmed bilateral ties, and Beijing also voiced support for Riyadh joining BRICS, an emerging economies association composed of Brazil, Russia, India, China and South Africa.

In his meeting with Prince Faisal, Wang said China appreciated Saudi Arabia’s pursuit of an independent energy policy and its active efforts to maintain the stability of the international energy market.

“The question now is whether the sharpening rivalry between the United States and China will lead China to expand its objectives to include the reduction of US influence on the region’s governments as well as the increase of its own,” said Chas Freeman, a former US ambassador to Saudi Arabia.

“The United States is now, to one extent or another, estranged from all the key actors in the Middle East.”

The fallout from the withdrawal of US troops from Afghanistan last year left many in the Middle East questioning America’s ability to manage complex regional conflicts and its credibility in global security partnerships. And its revived “pivot to Asia” policy, which is focused on competing with China, has left partners in the Middle East concerned about US disengagement from the region.

“After two decades of failed military operations in Iraq and Afghanistan, public opinion also favours the US taking a less active role in the Middle East,” said Gedaliah Afterman, head of the Asia policy programme at the Abba Eban Institute for International Diplomacy at Israel’s Reichman University.

A poll conducted in nine Arab states in August by the Arab Barometer, a research programme based at Princeton University in the US, found that only Moroccans favoured the US over China. The other states involved in the survey were Iraq, Jordan, Lebanon, Libya, Mauritania, Palestine, Tunisia and Sudan.

“With the ongoing uncertainty surrounding US commitment in the Middle East, many countries in the region are growing wary of remaining overreliant on the US,” Afterman said. “This dynamic creates an opportunity for China to increase its involvement in the region.

“Many countries in the region view China as an important trading partner, as well as a major power that is there to stay for the foreseeable future.”

While the US is limiting its strategic involvement in the Middle East, China has been expanding its presence on all fronts.

Xi set out a clear policy towards the Middle East in 2016: a “1+2+3” policy with energy cooperation as the main axis; infrastructure, and trade and investment as the two wings; and nuclear energy, aerospace and satellites, and new energy as the three breakthrough points.

China has closely adhered to that policy in recent years, with its outcomes generally welcomed in the region. Besides Russia, Middle East nations have been the main oil suppliers to China, while China remains the region’s biggest trade partner. Middle East nations have also been the major recipient of belt and road investment, which builds infrastructure to promote trade.

“China is the most capable country for building infrastructure projects in the world, and it’s easiest for China to control their costs,” said Victor Gao Zhikai, deputy director of the Centre for China and Globalisation, a think tank based in Beijing. “So if for industrialisation, manufacturing, or urbanisation, China will definitely deepen cooperation with Middle East countries in these areas.”

China’s flourishing economic relations with the Middle East have also led to greater use of the renminbi, the Chinese currency, in the region. In 2015, the first renminbi clearance centre in the Middle East was set up in Qatar, with another one opening in the United Arab Emirates the next year. Saudi Arabia has reportedly accelerated talks with China on accepting renminbi for oil, which many see as a result of growing tensions between Washington and Riyadh.

However, Zha Daojiong, a Peking University professor who specialises in economics and energy, said it was natural for Saudi Arabia to accelerate the adoption of renminbi payments for oil because China was a major customer. He said the decision had more to do with “changing dynamics of the world’s energy markets than geostrategic factors affecting Saudi-US relations”.

“The actual attraction of the renminbi in the Middle East will depend on the degree of economic integration between the two sides,” Zha said. “When Chinese investments in the oil and non-oil sectors of the Middle Eastern economies become deeper and more widespread, the renminbi stands a better chance of utilisation there.”

Beyond economic relations, China has entered “comprehensive strategic partnerships” with four Middle East countries – Egypt, Iran, Saudi Arabia and the UAE – pledging all-round cooperation on diplomacy, economics and security. Other efforts include advocating Middle East countries’ membership of multilateral organisations. Besides Saudi Arabia seeking to join BRICS, Iran is applying for membership of the Shanghai Cooperation Organisation.

Last week’s energy meeting between Saudi Arabia and China pledged to strengthen energy cooperation, including on nuclear safety, amid US concerns about Riyadh’s nuclear ambitions and its cooperation with China on nuclear projects.

China has signed a few memorandums of understanding on nuclear energy projects with Saudi Arabia over the past few years, including one on the construction of a high-temperature gas-cooled reactor that was signed during Xi’s visit to the kingdom in 2016.

Li Shaoxian, a Middle East expert at Ningxia University, said new energy was an area of focus for future China-Saudi cooperation because Riyadh was seeking to diversify its economy and reduce its economic dependence on oil.

“Chinese technology for third-generation nuclear power plants has certain competitiveness in the world, so this is also one of the future areas of cooperation between China and the Middle East countries,” he said.

Li said he also expected closer hi-tech and aerospace cooperation between China and Middle East countries. The UAE signed an agreement with China last month that would see a UAE rover sent to the moon on the Chang’e 7 mission in 2026. China had also significantly increased hi-tech cooperation with Israel before 2018, but that had declined in recent years due to closer scrutiny from the US.

The US has expressed concern about China building sensitive infrastructure in the Middle East, and was outraged when Israel approved the construction of a China-built cargo terminal in the city of Haifa, fearing possible surveillance of US Navy vessels that frequently dock nearby.

Li said China would continue to be cautious when weighing up security cooperation in the region, but it could become a source of arms if Middle East countries were unable to get them from the US.

“They have more choices now, unlike before,” he said. “Great powers see their importance, so they have a lot of room for manoeuvre.”

China has supplied a limited number of armaments to the Middle East, mostly drones, to countries including the UAE, Saudi Arabia, Iran and Egypt. It also sold ballistic missiles to Saudi Arabia in the past and has reportedly been helping it develop its own missiles.

Amid concerns that China, Russia and Iran could fill America’s shoes in the Middle East following Iran’s sale of drones to Russia for use in the war in Ukraine, senior US State Department official Jennifer Gavito said Washington would not walk away from the Middle East.

But Freeman said: “Even without the inroads China and others are making in the region, the United States needs to consider how best to adjust its policies to rebuild the influence it has lost.”