What will China’s stricter regulation control under Xi Jinping imply for the economy?

As conflicts with the US increase, Beijing has simplified financial oversight and increased study.

Please make use of the sharing options available through the share icon located at the top or side of stories. Copying stories to distribute to others is against FT.com’s terms of service and copyright policy. To purchase more rights, send an email to [email protected]. Using the present article service, subscribers may distribute up to 10 or 20 articles each month. You can learn more at https://www.ft.com/tour.

https://www.ft.com/content/60a7c8ad-eba8-4030-899d-ffb760d005c4

Chinese President Xi Jinping is planning to strengthen financial security at home while attempting to keep up in a fierce competition with the US over technology. He is doing this by making significant changes to financial and technological legislation.

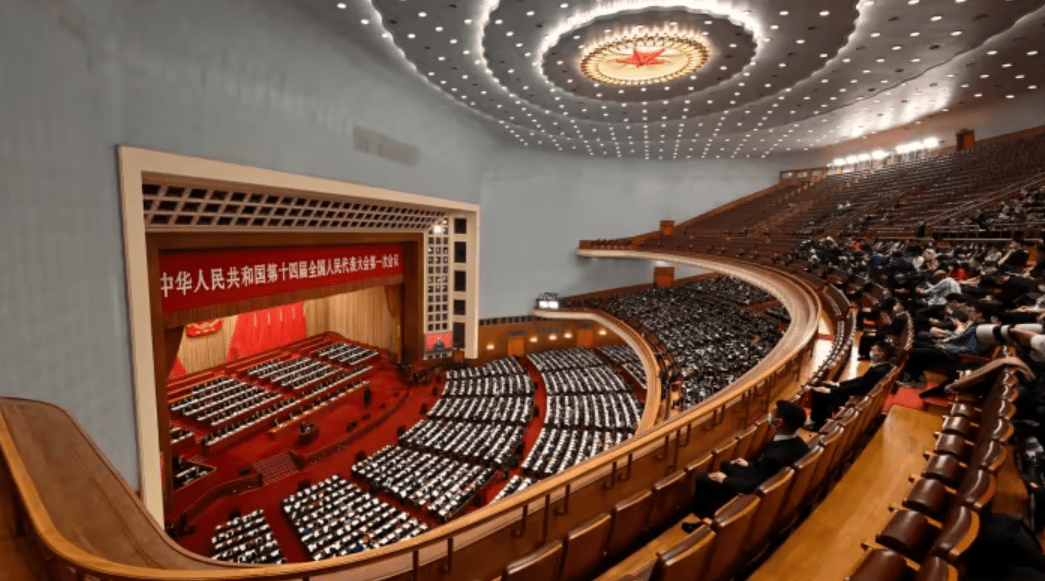

The State Council, China’s cabinet, and government departments have undergone significant changes as a result of the announcements made this week at the yearly meeting of the nation’s rubber-stamp senate.

Analysts claim that the motivation behind the actions is Xi’s and the party’s leadership’s desire to exert closer control over the state’s tools as the Chinese president begins an unusual third five-year term.

What adjustments are being made to the regulation of the banking sector?

One of the biggest changes is the new body to regulate the financial industry replacing China’s banking authority, the China Banking and Insurance Regulatory Commission.

The China stocks regulating Commission, the market administrator, will continue to oversee the stocks market as before, but a new national financial regulating agency will be in charge of overseeing everything else.

The organization will also assume some of the People’s Bank of China’s central bank’s regulatory duties, such as control over state-owned corporations like Citic Group and technology firms like Alibaba’s Ant Group. Additionally, it will take on some of the CSRC’s customer safety tasks.

The CSRC’s authority will be expanded with the addition of the evaluation of corporate bond issuing, giving it more control over the market for local government bond issues, which have come under greater examination due to their high levels of debt.

The adjustments, according to experts, were a move toward a more global “twin peaks” model of financial regulation, with one agency focusing on market behavior and customer safety and the other on the security and policy of the financial system.

Why now, and what adjustments will have what effects on the economy?

Previously, the PBoC’s singular agency handled all financial regulation; however, as the economy has expanded, so too has the regulatory framework.

Numerous national and municipal agencies have struggled to keep up with developing dangers and new business models, such as peer-to-peer loans and consumer payment applications.

According to Shen Jianguang, chief economist at JD.com, “the main goal is to unify the regulatory framework because in the past, a lot of non-banking financial industries had developed very quickly.”

A strengthened central regulating body is also probably going to be more involved in overseeing regional banking operations.

Zheng Zhigang, a scholar of economics at Renmin University of China, stated that there wasn’t enough oversight in the past. He used a controversy that last year led to local bank runs as an illustration of the need for more stringent regulation. “The new institution’s establishment clarifies the role of the financial supervision system.”

Additionally, this should enable the central bank to concentrate on monetary policy formulation and macroprudential oversight.

UBS analyst Zhang Ning hypothesized that one of the shifts is “the government trying to differentiate between so-called macroprudential regulation versus micro-regulation.” The government’s priorities are to increase productivity and decrease significant financial threats.

The government could have increased the authority of the current CBIRC rather than making significant adjustments at a time when Xi was also preparing to reorganize the government’s complete economic team, according to Fraser Howie, an independent specialist on China’s finance sector. Howie commented, “You’re changing the structure at the same time as you’re changing all the people,” and added, “It seems to be a solution to a problem they don’t have.”

What is driving China’s reform of its technology regulations and how will it impact Chinese research?

Washington’s implementation of export restrictions prohibiting US companies from selling cutting-edge chipmaking machinery to Chinese organizations has had a significant negative impact on the tech industry.

Beijing has given the task of catching up to the west in invention and science to a new Communist party science committee that reports to Xi. Along with a revitalized Ministry of Science and Technology, this will be effective.

High-ranking State Council official Xiao Jie announced the changes on Tuesday. “Facing tough science and technology competition globally and external containment efforts, we must straighten out leadership and management of science and technology,” he said.

According to him, the reorganization would establish “a new type of whole-country system” for technological advances and centralize party authority over the nation’s research and development initiatives. According to the State Council, the Ministry of Science and Technology will work to establish national laboratories, manage initiatives, promote tech employees, and ease technology transfer.

As a result of the US and its partners’ tighter semiconductor embargo, Graham Webster, a China specialist at the Stanford Cyber Policy Center, stated that China is worried about its technical future.

A governmental focus on the internet world has been present for years, but it is based on sand, he claimed. “There is currently a rebalancing of the bureaucracy to advance deep industrial capabilities and fundamental science.”

China will also establish a national data administration to make use of the enormous amounts of data the nation has amassed, develop a national big data strategy, and take the lead in the digitalization of the government and industry.

The office will be based in the nation’s state planning organization and assume some duties related to collecting data from China’s potent internet authority, which will continue to serve as the monitor over major tech companies.

Will there be additional changes?

Since the legislative session won’t end until the following week, more adjustments might be made.

The declaration of any alternative Communist party organizations to oversee the finance industry and other sectors will be closely watched by analysts.

Analysts predict that these will offer Xi even more direct influence over governmental institutions. The party’s leadership stated last week that the structural changes are “part of broader efforts to enhance the party’s leadership over the nation’s socialist modernization.”

The individuals appointed to lead the different organizations will be equally important, and the National People’s Congress is anticipated to decide on the nominations this weekend.

According to individuals with knowledge of the situation, Yi Huiman, the esteemed present director of the CSRC, is one of the leading contenders to run the new finance regulating agency.