Can the ed-tech boom last?

B YJU’S WAS piling on users even before covid-19 closed classrooms around the world. India’s most valuable private startup was co-founded in 2011 by Byju Raveendran, a celebrity maths tutor whose classes have drawn crowds big enough to fill stadiums. By 2019 tens of millions of Indian children had signed up to use the firm’s flagship product, an app that serves up online lessons intended to supplement regular schooling. That year Byju’s began sponsoring India’s national cricket team.

Listen to this story. Enjoy more audio and podcasts on iOS or Android Your browser does not support the

Since then India’s schools have spent more time shut than open—and the fortunes of Byju’s have only improved. The number of children whose parents pay for them to have full use of its app has more than doubled, to 7m. Late last year investors valued the firm at over $20bn, a three-fold increase since pre-covid days. In January Bloomberg reported that Byju’s may soon unveil plans to go public in New York, by merging with a blank-cheque company. The news agency had previously rumoured that such a deal could raise around $4bn, valuing the firm at a cool $48bn.

Byju’s is the biggest of a clutch of young companies benefiting from breakneck growth in online learning. Venture capitalists ( VC s) plonked around $21bn into education technology companies in 2021, according to Holon IQ , a research firm (see chart). That was three times the amount raised in 2019 and 40 times more than a decade ago. Seventeen ed-tech startups became “unicorns” (private companies valued at more than $1bn), three times as many as had passed that milestone during any previous year. Half a dozen of them went public. They included Coursera, a marketplace for online courses with a stock market value of nearly $3bn, and Duolingo, an app for language learners which is worth around $4bn. Holon IQ has predicted that global ed-tech revenues could almost double from $227bn that year to around $400bn in 2025, a fifth higher than its pre-pandemic forecast.

Until recently ed-tech firms had rarely made investors sit up. Schools and universities control much of the $6trn spent globally on education each year. They tend to be cash-strapped and conservative. In 2019 only about 3% of all education spending went on software or online teaching. Tory Patterson of Owl Ventures, who began investing in ed-tech firms in 2009, admits that speaking up for the sector has sometimes won him “blank stares”.

No more. The closure of school buildings and college campuses forced educators to try out new kit (especially in India and America, where disruptions to learning have been particularly drawn out). Governments have given children stacks of tablet computers and sped up efforts to improve broadband in schools. They have also given teachers extra cash to spend on tools they think will help pupils “catch up”. Lawmakers in America have earmarked an extra $200bn or so for schools since the pandemic started. That sum is equal to about one-quarter of what is spent on these institutions in a typical year.

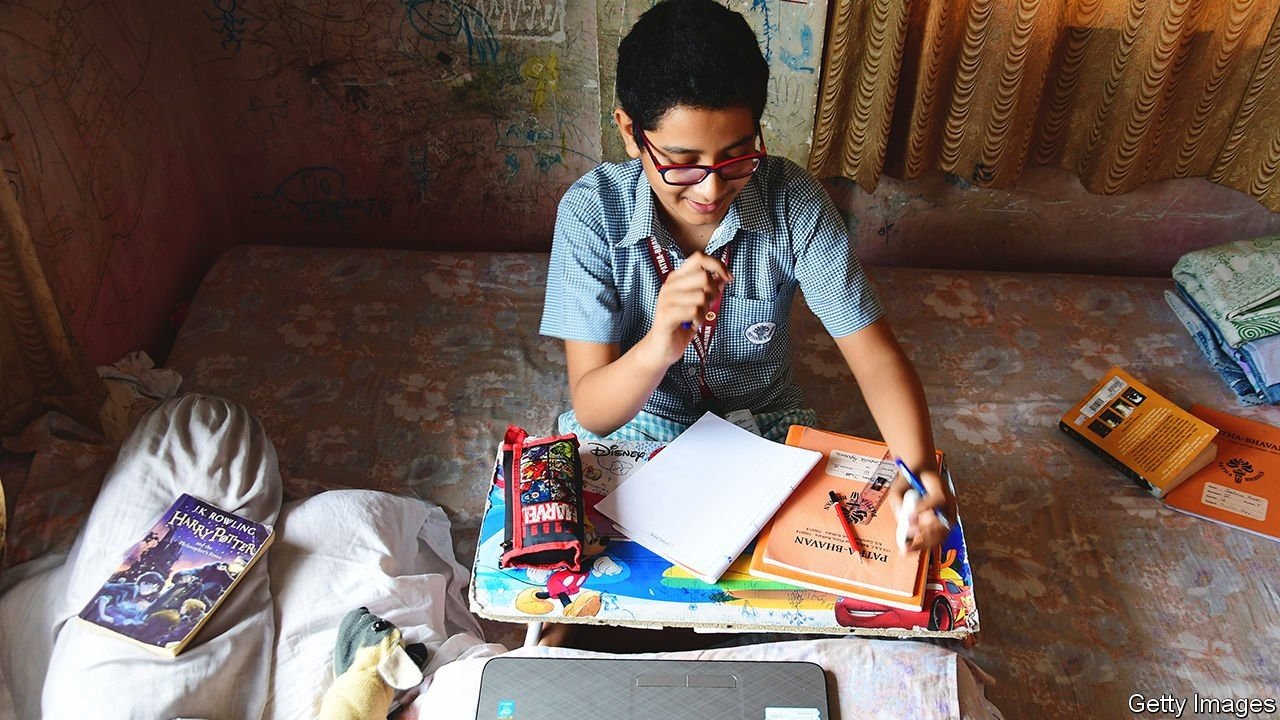

For years many of the zippiest ed-tech firms have chosen not to sell to schools and universities but to go direct to learners. This category of companies has also benefited during the pandemic. Parents in Asia have long been keen to pay for tutoring and other services (such as Byju’s app) that might give their offspring an edge. Now families in Europe and America are also getting keen. Supervising remote learning has made parents everywhere more engaged in their children’s education, more aware of how they are performing in comparison to classmates and in some cases more critical of what they are being taught. Companies that offer after-school lessons—such as Outschool, an American unicorn, and GoStudent, an Austrian one—are growing fast as a result.

Another type of outfit getting a boost from the pandemic are those that offer learning to adults. Workers furloughed during lockdowns commonly took online courses that they thought would improve their prospects. Remote working has made more roles plausible to more jobseekers, giving them more reason to reskill. At the same time, a flurry of job-switching in Britain and America has made big employers nervous. They are becoming more convinced that spending on staff training can help them hang on to workers and cut the cost of plugging holes. This is benefiting companies such as Coursera, which says selling subscriptions to corporate customers is its fastest-growing business. Up-and-coming firms include Guild, which helps blue-collar workers at giants such as Walmart and Disney gain new qualifications, and Better Up, an American company that helps professionals find coaching.

Ed-tech’s pandemic report card is not without blemishes, however. In China, its single biggest market, the Communist Party declared last July that businesses could not typically make a profit from providing after-school tutoring to children in primary and middle schools. The regime has worried for years that huge demand for private education is widening inequalities and impoverishing the middle class. Even charitable tutoring could no longer take place during holidays and at weekends. Within days the share prices of New Oriental, TAL Education and Gaotu, the industry’s three listed Chinese giants, had fallen by two-thirds, wiping out $18bn in stockmarket value. Since February 2021 their collective worth has shrivelled from more than $100bn to less than $10bn. China’s most celebrated ed-tech unicorns, Yuanfudao and Zuoyebang, could be worth a fraction of their pre-crackdown valuations of $15.5bn and $10bn, respectively.

The Chinese experience has rattled investors, says Thomas Singlehurst of Citigroup, a bank. It blocked a possible exit route for Western startups, some of whose VC backers may have hoped to sell them to China’s ed-tech titans. It may also inspire tighter rules in next-door India, another potentially vast market where some parents accuse ed-tech firms of misleading ads and aggressive sales tactics. Last month India’s education minister said the government was considering new regulation, though he gave no details. Since then at least 15 Indian ed-tech companies, including Byju’s, have created a group promising to scribble new codes of conduct.

Western ed-tech firms are unlikely to face similar strictures. But they have their own challenges. In November Chegg, an American company that gives online help to undergraduates, warned that lower-than-usual enrolment in American universities was affecting its revenue. Its market capitalisation, which soared to around $14bn in early 2021, is back down to $4bn, lower than it was before the pandemic. Shares in ed-tech companies that listed in America last year are mostly trading below offer price. Several, including Coursera and Duolingo, have yet to turn a profit.

Not straight As, then. But the industry’s boosters think it has room to improve. An influx of users and money in the pandemic has given more firms the muscle to expand abroad and to find ways of retaining users for longer, reckons Deborah Quazzo of GSV , a big educational investor. Take Byju’s. It has spent at least $2.8bn on a dozen acquisitions in an apparent attempt to string together services that will allow it to reach learners of all ages, from toddlers to career-changers. The deals are also helping it reach customers far beyond India. In 2021 it began offering online classes in coding and maths to children in America, Brazil, Britain, Indonesia and elsewhere. A big listing might teach ed-tech sceptics and Western rivals alike a lesson. ■

Dig deeper

All our stories relating to the pandemic can be found on our coronavirus hub. You can also find trackers showing the global roll-out of vaccines, excess deaths by country and the virus’s spread across Europe.

For more expert analysis of the biggest stories in economics, business and markets, sign up to Money Talks, our weekly newsletter.