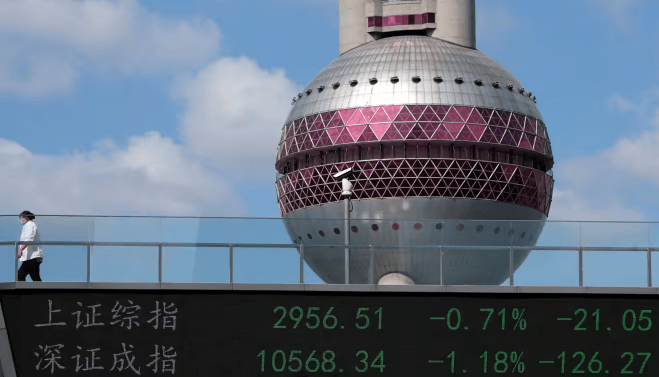

China’s equities and yuan are under pressure from three factors.

SHENZHEN — Chinese financial markets are being pressured by a sluggish economic recovery, worries of deflation, and risk-averse foreign investors, which is bringing down both stock prices and the value of the yuan.

After the government relaxed its zero-COVID limits in December, the Chinese economy recovered. However, the recovery has slowed down.

Meanwhile, using monetary stimulus to boost GDP runs the danger of driving the yuan further down.

Goldman Sachs hinted at the possibility of revising its growth projection for China in the April-June quarter downward from its current 4.9% after key economic data for April significantly missed market expectations.

Goldman kept its 6% full-year prediction but cautioned that if economic confidence kept eroding, the downturn may last longer.

The real estate industry, which makes about 20% to 30% of the gross domestic product when coupled with associated businesses, is nevertheless experiencing weak demand. In April, new house sales in China declined 11.8% year over year by region, which was a greater decline than the 3.5% in March.

The provincial governments, which get a significant percentage of their income from selling land-use rights to developers, have taken a hit as a result of this downturn.

The financial stability of a government-backed infrastructure investment firm has come under examination in the southern city of Kunming. Following the reported release of documents from an expert panel warning of a potential default on social media, the municipal government on Wednesday made an unprecedented statement pleading with the populace to disregard “rumors.”

The rate of price increase in China has also been declining for a long time. Its consumer price index edged closer to negative growth in April, rising 0.1% year over year.

Fu Linghui, a spokeswoman for the National Bureau of Statistics, told reporters on May 16 that there was no deflation in the Chinese economy.

However, according to statistics from the Chinese research firm Wind, the consumer price indices for the provinces of Jilin, Shanxi, Guizhou, Liaoning, Anhui, and Henan, as well as the city of Shanghai, showed negative growth in April.

As university graduates struggle to find work in the midst of a delayed recovery, the unemployment rate for people between the ages of 16 and 24 has surpassed the 20% threshold. Household expenditure has been deterred by future uncertainty.

Long-term interest rates, a leading indication of the general state of the economy, are being impacted by weak economic fundamentals. When the nation was still subject to zero-COVID limitations, the benchmark 10-year government bond yield dropped to 2.69% on Tuesday, its lowest level since November.

It is getting close to the lowest recorded percentage in Refinitiv records, which was 2.35% in June 2002.

A weaker yuan results from lower rates. On May 17, the Chinese currency declined beyond 7 yuan to the dollar, passing a psychological barrier.

The China Foreign Exchange Committee, which includes representatives from the Chinese central bank, addressed reducing exchange rate volatility in a meeting the next day. Nevertheless, despite this browbeating by authorities, the yuan weakened more, reaching an almost six-month low on Friday in Shanghai.

Due to these concerns, American and other international investors steer clear of Chinese equities. The tendency is also influenced by U.S.-China tensions over Taiwan, IT industry regulation, and the possibility of economic penalties.

According to an analyst at China-based Soochow Securities, markets that are seen favorably by the United States, such as Japan, are preferred instead.

The Shanghai Composite Index, which monitors mainland companies mostly traded by Chinese investors, has increased by 4% since the year’s end. The Hang Seng Index is down 5% in Hong Kong, where foreign money is permitted to come and leave at will. The Nasdaq Golden Dragon China Index, which monitors Chinese equities listed on U.S. exchanges and mostly traded by American investors, fell 10%.

Stocks of companies targeted by Beijing’s tech crackdown, including as Tencent Holdings and Alibaba Group Holding, have plummeted. Because of new Chinese limitations on the American chipmaker Micron Technology, there may be even more of a decrease in U.S. investment in Chinese companies.