Africa this time around: Chinese drawn in by unrealized potential claim that it’s a “not ideal market,” but one “where we could survive.”

This article is the second of a two-part series examining the situation of trade and tourism between China and Africa at the moment. The Tanzanian embassy in China organized a two-week promotional tour to Tanzania in May, and The Post took part. Part one is available here.

The travels started as soon as China’s borders were reopened in early January. Thousands of Chinese producers set out to participate in international exhibitions and trade shows, moving like a herd of wildebeests in search of new customers and eager to reconnect with long-term ones.

Others headed straight for conventions like the Consumer Electronics Show (CES) in Las Vegas, but a 30-member team had industrial parks and trade zones in Africa in mind.

Do you have inquiries concerning the most significant issues and global trends? Discover the solutions with SCMP Knowledge, a brand-new platform including selected content from our award-winning team that includes explainers, FAQs, analyses, and infographics.

On a journey planned by regional commerce officials to support Foshan industries’ worldwide expansion and continued competitiveness, the delegation left the industrial powerhouse of Foshan in south China’s Guangdong province in May. The idea was that compared to many other locations, Africa provides unexplored prospects, cheaper prices, and less trade impediments.

Feng Jianping, a member of the delegation, has benefited by negotiating deals to sell rechargeable fans to African families in several nations on the continent.

There will be a commercial boom in Africa.

exporter of small appliances

The supplier of tiny household appliances said that “the market explosion in Africa is yet to come.”

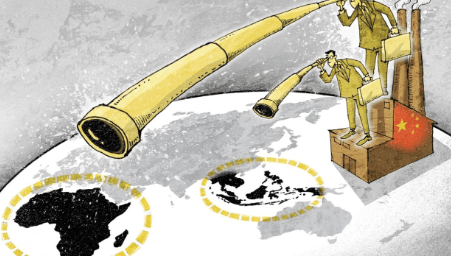

The market in Southeast Asia is mostly saturated. While Africa has more than 1.4 billion people and the market still has many unmet demands, it has [nearly 700 million] people and too many Chinese investors.

When Chinese labor-intensive enterprises contemplate moving plants abroad, Africa has managed to improve its standing among Chinese merchants looking to develop their foreign operations.

As local manufacturing prices increase, competition heats up, and US-bound exports are hampered by tariffs and non-trade obstacles, supply-chain shifts of this kind are becoming more and more prevalent.

Due to the competition between the two greatest economies in the world, many Chinese companies claim they are terrified of being cut off from American supply chains and replaced by equivalents in Southeast Asia or India.

A significantly longer-term business approach is to invest in Africa.

Tanzanian Janson Huang

“Chinese companies have to bite the bullet now – first we were cracked down on by the US, and soon we will be targeted by Europe,” Feng said, adding that the situation has already compelled them to act. Were we supposed to wait until we were the target before formulating a strategy?

And what role does Africa play? Well, she said, “it’s not the ideal market, but it’s a market where we might exist.

The third China-Africa Economic and Trade Expo will get underway soon in Changsha, the provincial capital of Hunan, with at least 50 African nations and eight international organizations expected to participate from June 29 to July 2. This will further strengthen trade ties between China and the continent.

“Investing in Africa is a much longer-term business strategy,” said Janson Huang, chairman of the Sinotan Industrial Park, which is situated outside of Dar es Salaam in Tanzania, an East African nation.

Huge US$3 billion trade increase in Hunan’s effort to become a gateway for China and Africa

The park’s construction got underway last year. It will cover about four square miles when it is built in the next five to eight years, and it has ambitious plans to draw more than 200 businesses, create 500,000 employment, and attract roughly US$3 billion in direct investment with an annual return of US$6 billion.

Huang claims that Africa will have significant economic growth potential over the next 10 years and that Southeast Asia is the place to watch in terms of industrial chain transformations over the next five years.

Although Southeast Asia offers certain benefits, such as being close to China and having better developed infrastructure and industrial chains, Huang observed that “building industrial parks in Southeast Asia now would already be considered late to the game, and all the costs have already gone up pretty high”.

He said, “There are various industrial parks that we have visited. “The land is about US$150 to US$200 per square metre, while it is US$15 per square metre here in Dar” – or at least ten times less expensive.

The appeal of the African continent has increased for both rising markets and as a place to relocate due to a variety of causes.

Africa presents a sizable consumer market with enormous potential due to its youthful and quickly expanding population; by 2050, the United Nations projects that one in four persons on Earth will be African. At the moment, it affects one in every 6.5 persons.

Rich natural resources, including mineral and energy reserves, and relatively cheap labor costs also provide profitable economic prospects.

Chinese investors are taking advantage of these favorable conditions as commercial relations between China and Africa continue to improve in order to establish cooperative connections and tap into the enormous potential that Africa has to offer.

China overtook the US to become Africa’s largest bilateral trading partner back in 2009. According to official Chinese data, bilateral commerce increased to a record of US$282 billion last year, more than 26 times the amount in 2000.

According to figures from the Chinese Ministry of Commerce, China made up 47.35 billion dollars of the total direct investments made in Africa by the end of 2020. Although some firms were not registered and certain investments were not included, the China-Africa corporate Council projected that the real Chinese corporate investment in Africa should not be less than US$56 billion in a study from 2021.

Additionally, the council’s study revealed that more than 70% of Chinese investment came from the private sector. The majority of the money was invested in factories and industrial parks, which aided in the industrialization of the host nations.

“Africa welcomes Chinese investment with open arms,” said Martin Mpana, head of the African Diplomatic Corps in China and the Cameroonian ambassador to China, in April. He added that the African side excitedly expects more Chinese businesses visiting the continent to investigate potential.

The most noteworthy Chinese investment in Africa, outside of the private sector, has been via Beijing’s Belt and Road Initiative, a ten-year government initiative to connect countries into a China-centered commercial network that includes several African states.

Washington has, however, often charged that Chinese economic efforts in Africa have saddled nations with debt they are unable to pay back. This idea has been rejected by Beijing.

China denies putting African nations in a “debt trap”

Private Chinese enterprises have also voiced worries about regional security and policy issues.

Such worries have been stoked by high-profile assaults on Chinese nationals working in unrest-prone areas, which grabbed headlines. For instance, a shooter in March murdered nine Chinese laborers at a gold mine. After a Chinese national was shot and killed in Ethiopia in January, Beijing’s embassy in Addis Abeba issued a warning to its people to avoid high-risk locations.

The most important factors should take into account while researching the African market, according to Dai Jufeng, a new-materials maker from Foshan who accompanied the trip to Africa in May. And if he does choose to do business on the continent, he would prefer to work with an industrial park supported by China.

Dai said, “We are unfamiliar with the surroundings here. And because they have been there for a while, industrial parks must have more resources and outlets. We must leverage their connections and resources to grow our company if we go out there and hope to succeed.

Electricity would be a major problem since the place we stayed at in South Africa had power outages three to four times each day.

Guangdong manufacturing Dai Jufeng

The investor said that the fact that his plant is partly automated and primarily caters to Chinese building contractors and interior design companies has also prevented him from taking such a step.

For producers of apparel and shoes, investing in Africa “might make more sense,” he added. Moving the whole manufacturing chain all the way across is likewise unfeasible. It would be very difficult to get raw materials and to repair and store machine components.

Dai said that despite this, he felt obligated to look into opportunities abroad since his company had been seriously harmed by the current real estate and economic collapse. Although he admits that Africa seems to be a viable market, he is more interested in established areas like Saudi Arabia or Vietnam.

“Electricity would be a big issue – the power went out three, four times a day in the hotel we stayed at in South Africa, indicating serious electricity shortages,” he said. Additionally, the cost of [electricity] increases by 20% year, which is demanding for a business like ours that uses a lot of energy.

Firms react to the new reality as the China withdrawal accelerates. “It’s a tricky time.”

Tim Zajontz, a research fellow at the Centre for International and Comparative Politics at Stellenbosch University in South Africa, noted that Chinese investments in such industrial parks in Africa have significantly increased over the past 20 years. Special economic zones have also long been marketed as useful tools for replicating the development trajectory seen in China.

In an attempt to “export” its own development expertise to Africa, Beijing aggressively supports Chinese investments in industrial parks and special economic zones, according to Zajontz.

In the hopes that they would jump-start economic diversification, generate employment, and have a positive ripple effect on other economic sectors, several African governments have encouraged investments in such zones.

“However, throughout the continent, the outcomes have been inconsistent. While tax vacations and regulatory exemptions were given to investors, certain zones were criticized for failing in terms of growing manufacturing and generating employment. An example of this is Ethiopia’s leather-processing sector.

Many African governments have provided Chinese investors with lax rules, tax breaks, and public lands. They have also established the required facilities within these zones and constructed the transportation infrastructure that connects them to other regions of the nation as well as to neighboring and international markets.

However, Zajontz believes that “future policy support will likely depend on the success of existing industrial parks and special economic zones”.

15 agreements signed during the presidential visit solidify connections between China and Tanzania.

Several significant industrial parks in Africa supported by China stand out for their size and importance.

With major Chinese investment, the Lekki Free Trade Zone in Nigeria is making great gains toward fostering industrialization and luring global companies. This vast industrial park is situated close to Lagos, Nigeria’s commercial center, and spans an area of 155 sq km. A broad variety of businesses, including manufacturing, logistics, and energy, have been drawn in by its integrated infrastructure and welcoming investment climate, aiding in Nigeria’s economic diversification and employment creation.

With a concentration on industries like textile and apparel manufacture, the Eastern Industrial Zone in Ethiopia has also made it easier to transfer technology, skills, and job possibilities to the local populace. The park has been essential in developing Ethiopia’s industrial capacities and establishing the nation as a centre for regional industry.

As opposed to “hot money,” industrial parks backed by China will deliver much-needed foreign direct investment, according to University of Nairobi professor X.N. Iraki. “They will also increase competition, which may lead to reduced costs and higher-quality products and services.

It benefits both parties. The Chinese prosper, and we get employment. Chinese investors are welcomed by the government because they will connect Africa to the larger Chinese market and offer technology, new talents, and competitiveness.

Investment zones and industrial parks are not miracle cures.

Zajontz, Tim

Businesses from other nations are also constructing industrial parks on the continent, joining the expanding number of Chinese industrial parks there. Through their own industrial parks, countries like India, Turkey, Germany, Japan, and South Korea have shown a growing presence in Africa.

Chinese investors can quickly establish new supply or value chains because of their strong networks, according to Zajontz.

They have also shown a high degree of context-dependent adaptability to local political and economic circumstances.

“For their part, African governments wish to see more Chinese investments in industries that are seen to be crucial for the industrialization of Africa. It goes without saying that there are great expectations for Chinese industrial parks to increase manufacturing and processing in Africa and provide employment in the so-called formal economy.

“However, their real influence on regional economic growth is largely dependent on how successfully such investments are incorporated with regional suppliers and firms. Investment zones and industrial parks are not miracle cures. They need all-encompassing industrial strategies that prioritize boosting regional value-added [industries] and generating spillover effects outside of specific investment hotspots.