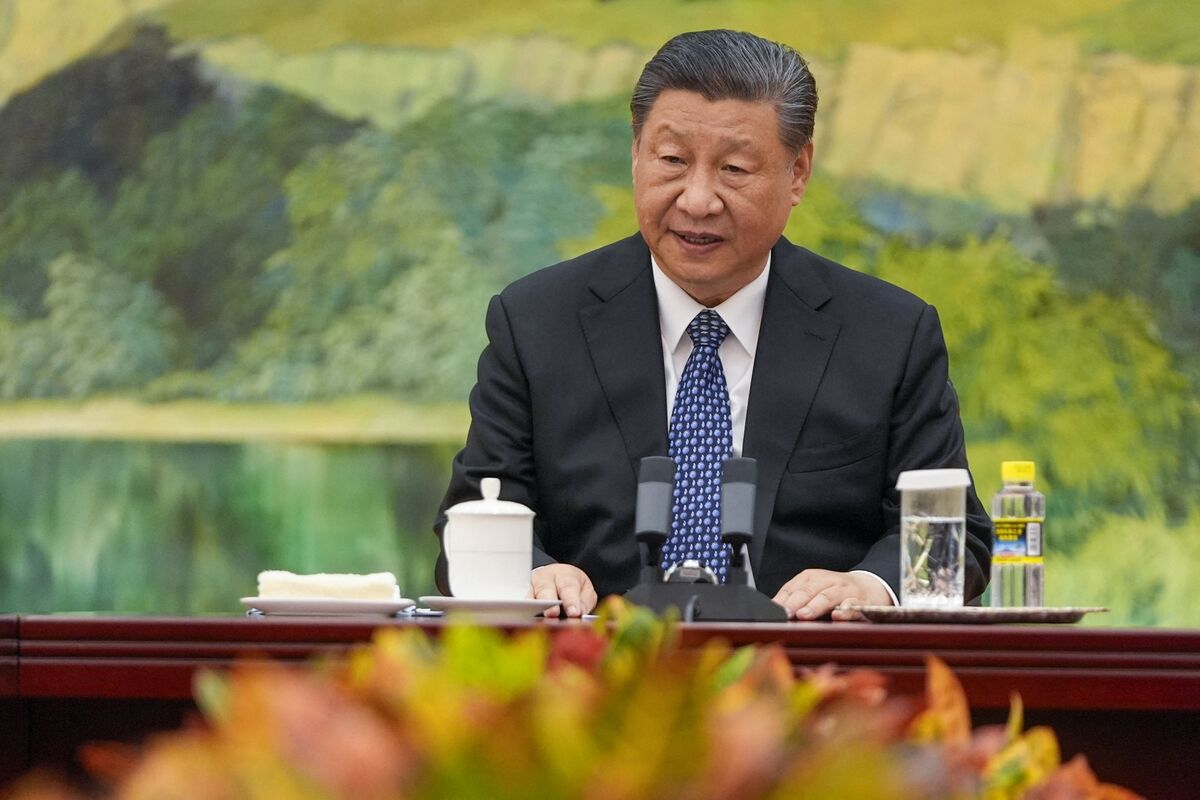

China’s bid to boost market’s confidence in Xi’s leadership fail

At the just concluded third plenum of the Communist Party of China’s Central Committee, an all-out effort was made to recast the image of President Xi Jinping as a bold reformer—all this to boost public confidence in his leadership.

But in the face of investors showing lukewarm response to policies and programmes chalked out at the third plenum to revive the country’s headwind facing economy, it does not appear the Chinese President will be able to put the brakes on rising discontent against him in China, including the CPC very soon.

Given the dwindling economic growth, weak demand at home and rising unemployment graph, the CPC’s Central Committee held the twice a decade political event, known as plenum for four-day last week. To buoy the mood of participants, which included 199 members and 165 alternate members of the Central Committee, President Xi Jinping in his opening remarks at the plenum called for moving towards national rejuvenation on all fronts through Chinese modernization, People’s Daily said.

To this regard, the CPC leaders at the four-day plenum mapped out over 300 initiatives. But within 24 hours of the announcement of these initiatives, the benchmark Hong Kong stock index fell, said Nikkei Asia.

The Shanghai Stock Exchange index also fell on July 22 and this happened even as the People’s Bank of China, the East Asian country’s central bank, announced cutting major short and long-term interest rates in order to boost growth in the country.

China’s GDP grew 4.7% on the year in the second quarter, while total household consumption stood at just 38% of GDP, compared to 60-70% in most developed nations. According to Rhodium Group, a US-based independent research provider, retail sales growth so far has reached only 3.7%–equivalent to only around 1percentage point of GDP growth, while household disposable income growth is only 5.4%.

Property crisis continues, with there no signs of mitigating it in near future. According to Goldman Sachs, the total value of unsold homes, unfinished projects and unused land in China has gone up to 30 trillion yuan ($4.1 trillion). Similarly, local government debt rose by 14.3% year on year to 41.4 trillion yuan (US$5.7 trillion) by the end of February, 2024, data obtained from China’s Ministry of Finance by state-backed Xinhua news agency showed.

On the other hand, doubt on the unemployment rate presented by the Chinese government has further deepened as the National Bureau of Statistics of China suddenly deregulated the publication of data on joblessness in August 2023. The jobless rate among China’s 16 to 24-year-old was more than 21% till July 2023.

When fresh data was released in December last year, the joblessness rate among people aged between 16 and 24-year-old showed hovering around 14.9%. By June 2024, it stood at 13.2%, leading to questioning a sudden change in employment scenario in China even as the economy is facing slowdown, while its struggle with deflationary pressure continues. Its trade tension with the US and Europe, among others, has dented the prospect of immediate turnaround in the economic situation.

In this background, the third plenum of the CPC’s Central Committee held a meeting last week where stress was laid on structural reforms to revive the crisis-hit Chinese economy. Both investors and economists, however, want immediate resuscitation of the Chinese economy by stimulating demand and acting more decisively on economic reforms, including support for private sector and foreign investment.

Presenting a critical view on plans and programmes chalked out at the third plenum, Yukon Huang, a Senior Fellow at the Carnegie Endowment, in his write up in South China Morning Post, said, “Many of the reforms highlighted in the third plenum discussions are seen as tinkering around the edges. They are institutional and regulatory refinements rather than sending a clear signal that market forces, not the state, will take the lead in guiding private sector activities.” He said China needs to act on growth-enhancing reforms that will not “add to its current financial difficulties.”

Nonetheless, what is argued in general by China watchers is whether reform measures discussed at the third plenum will help assuage rising discontent among common people against the CPC leadership.

The East Asian country’s construction, financial, housing and several other sectors are grappling with huge problems. In the financial sector, many banks have resorted to at least a 10 to 20% salary cut, while a dip in manufacturing activity has led to huge retrenchment of factory workers.

There is already a huge discontent among senior/retired people of the country against President Xi Jinping as the Chinese government has introduced a cut in their medical and other social benefits. On the other hand, as per Bloomberg, a large number of retirement mutual funds have been closed down as they have failed to attract enough investors, giving a major blow to pension schemes meant for the aging population in China. Amid this, labour protests have increased sharply since August 2023.

According to New York-based Freedom House, labour protests in China more than tripled in the fourth quarter of 2023 compared with the same period in 2022. Analysts say this unrest is linked to China’s ongoing economic woes and difficulties faced by common labourers in running their house and hearth in the country.

In the last six months, there were 1104 strikes in China and 976 calls for help by workers, demanding clearance of their wages, the Hong Kong based China Labour Bureau reported in January 2024. As per Radio Free Asia, bus companies in Beijing and other cities have hired security guards so that each bus has at least two to three of these guards to prevent emergencies amidst the waves of layoffs across companies in China.

To assuage growing disaffection among Chinese people and bring some dynamism in the market, a last-ditch effort was made by the CPC leadership to come out with policy and programmes at the third plenum to boost the country’s economy, but given the initial response to reform initiatives by investors, it does not appear President Xi Jinping will have a happy sleep at night, analysts say.

Rather, they say President Xi will face major challenges in steadying China’s export-oriented economy because the US and Europe, which serve as big markets for Chinese products, continue being unsparing in tightening the noose around imports from the East Asian country.