*First-quarter economic growth in China was 4.5%.

*U.S. interest rates and the strength of the dollar weigh

*Baghdad and the KRG move forward Iraq restarted northern oil exports

*API supply report will be available at 2030 GMT.

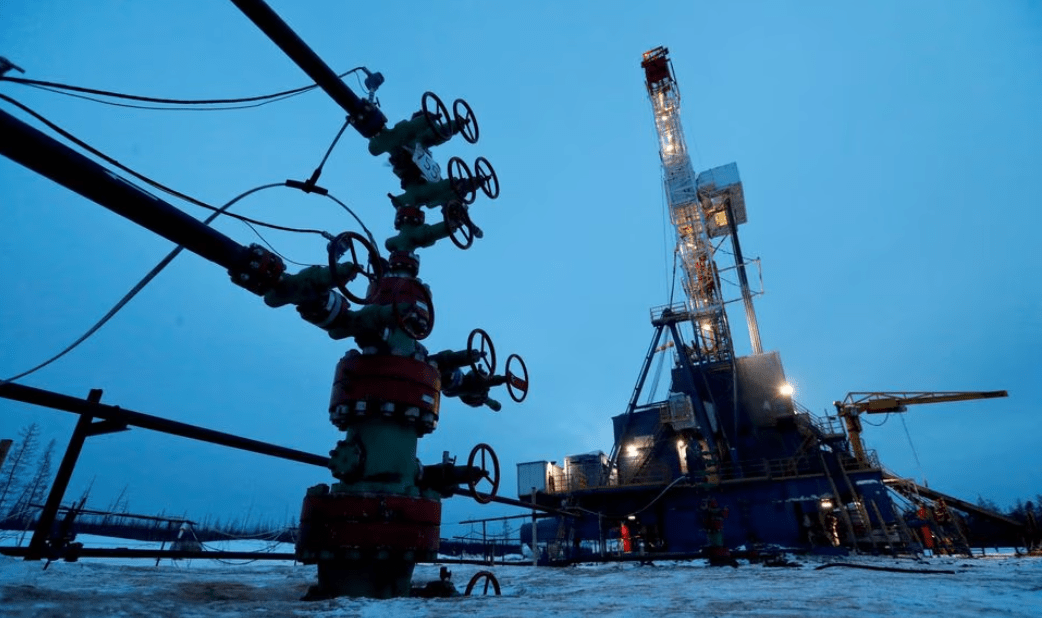

Tuesday saw a second day of oil declines as positive economic data from China failed to divert attention from potential increases in U.S. interest rates and broader concerns about the future for growth.

The Kurdistan Regional Government (KRG) and the federal government of Iraq exerted pressure on crude by moving to resume northern oil shipments through the Turkish port of Ceyhan after they were suspended last month.

By 1336 GMT, Brent oil had lost some of its early gains and dropped by 18 cents, or 0.2%, to $84.58 per barrel. To $80.81, U.S. West Texas Intermediate dropped 2 cents.

The prognosis for oil prices was discussed by Craig Erlam of brokerage OANDA. “The next step may depend on global growth and whether the economy can weather the recent storm, particularly in the U.S., where tighter credit could significantly weigh on growth for the rest of the year,” he said.

Data indicating that China’s GDP expanded by a faster-than-anticipated 4.5% in the first quarter and that oil refinery throughput increased to record levels in March helped oil find support earlier in the session.

According to Stephen Brennock of oil trader PVM, “As things stand, China is operating normally, much to the relief of those betting on higher oil prices.”

However, the likelihood of another rise in interest rates in the United States, which has been boosting the value of the dollar, continued to dampen mood. Traders anticipate a 25 basis point rate increase from the US Federal Reserve at its meeting in May.

After previous advances, the dollar weakened on Tuesday. The price of goods denominated in the dollar increases for customers using foreign currencies.

The most recent inventory snapshot for the United States will be in the spotlight on Tuesday. Analysts predict a 2.5 million barrel drop in U.S. crude stocks as well as drops in gasoline and distillates.

The American Petroleum Institute is scheduled to release the first of this week’s two assessments at 2030 GMT.

Leave a Reply