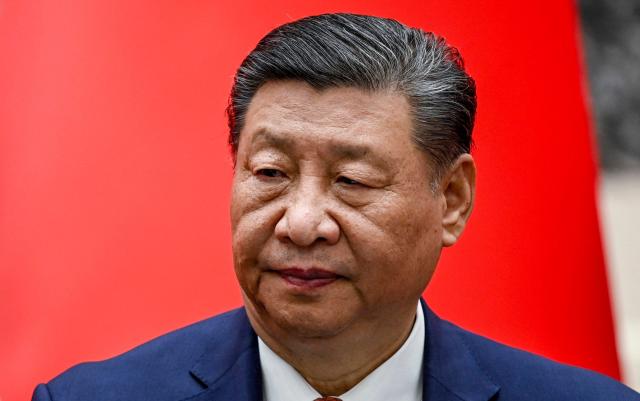

Hong Kong Developer suffers major setback under Xi’s policies

In a city renowned for its dramatic real estate fluctuations, Hong Kong’s current property slump is particularly striking. The downturn in home prices is on the verge of hitting a five-year milestone, marking the longest decline since the severe impact of the SARS crisis over two decades ago.

The situation is dire. When factoring in the losses from commercial properties, a staggering HK$2.1 trillion (approximately $270 billion) has been wiped off the city’s real estate values since 2019, as highlighted by a recent Bloomberg Intelligence analysis. The outlook remains bleak, with experts from UBS and CBRE forecasting further declines.

Much like other major cities such as New York and London, Hong Kong is grappling with a combination of rising interest rates, job losses in the financial sector, and evolving work habits. However, for many residents, the property slump has become a stark indicator of a more troubling trend: a growing loss of confidence in Hong Kong’s position as Asia’s leading financial center.

The situation has become so dire that homeowners are now considering what was once unimaginable — selling their properties at a loss.

One of Hong Kong’s largest developers, New World Development, is anticipating its first loss in two decades. The company, owned by the billionaire Cheng family, expects to report a loss of up to HK$20 billion (£2 billion) for the financial year ending in June. This downturn is attributed to President Xi Jinping’s crackdown on China’s property market, the departure of Western businesses, and rising interest rates. Additionally, the depreciation of the renminbi has further exacerbated the situation. Core profit is projected to decline by as much as 23%.

New World Development’s shares plummeted to a 21-year low of approximately HK$6.80 on Monday after the latest financial update. Founded in 1970, the company’s diverse investments in residential developments, shopping malls, offices, and hotels make it a barometer for Hong Kong’s economic health. The special administrative region has experienced recurring recessions since the pandemic, during which Beijing tightened its grip by implementing a controversial security law.

This power consolidation has significantly impacted civic society, forcing pro-democracy activists into exile. Consequently, many Western businesses have scaled back their presence in Hong Kong, leading to a decline in investment. Earlier this year, former Morgan Stanley Asia chairman Stephen Roach wrote in the Financial Times, “It pains me to admit it, but Hong Kong is now over,” referring to the region’s Hang Seng stock market.

The property market in Hong Kong has been significantly impacted by the prolonged economic slowdown in mainland China. Since 2021, the Chinese government has imposed stricter regulations on the amount developers can borrow, leading to a crisis in the heavily indebted property sector. This has resulted in several major developers defaulting on their debts, with Evergrande being the most notable, forced into liquidation earlier this year after accumulating a debt of HK$328 billion.

According to the latest data from CBRE, home prices in Hong Kong are projected to decline by up to 10% for the remainder of the year. Official government statistics indicate that residential prices have already fallen by 3.1% in the first half of 2024.

New World Development is the latest in a line of Hong Kong developers showing signs of financial strain. Last month, Henderson Land Development reported a half-year loss of HK$2.3 billion. Despite President Xi Jinping’s efforts to revive the struggling property sector, success has been limited.

In May, the government introduced a policy package aimed at enticing buyers back into the market by relaxing mortgage rules. Additionally, the central bank launched a 300 billion yuan (£32 billion) “re-lending” facility to help state-owned enterprises purchase unsold commercial flats for affordable housing.

Despite these measures, concerns persist. UBS recently downgraded its forecast for the Chinese economy, citing the ongoing property slump as a key factor. The investment bank reduced its growth projection for next year from 4.6% to 4%.

New World Development, a major player in Hong Kong’s real estate market, is bracing for its first loss in two decades, with anticipated losses reaching up to HK$20 billion (£2 billion) for the financial year ending in June. This financial setback is largely due to President Xi Jinping’s stringent policies on China’s property market, the withdrawal of Western businesses, and rising interest rates. The depreciation of the renminbi has further compounded the issue, leading to an expected 23% decline in core profit. The company’s shares recently hit a 21-year low, trading around HK$6.80. Despite government interventions aimed at revitalizing the property sector, such as easing mortgage rules and introducing a 300 billion yuan (£32 billion) “re-lending” facility, concerns remain. UBS has downgraded its economic forecast for China, citing the prolonged property slump as a significant factor, and has reduced its growth projection for next year from 4.6% to 4%.