Regulators assist Hong Kong’s role in linking China with global markets by lending their voices.

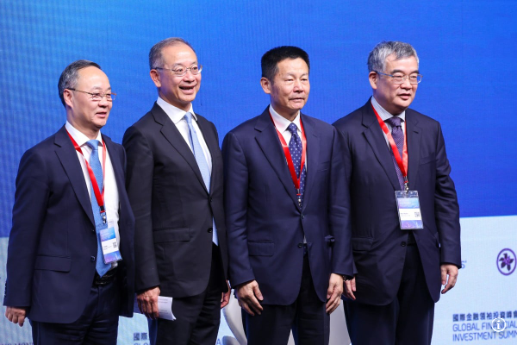

Chinese officials in charge of three parts of the world’s second-largest capital market descended on the nation’s offshore financial centre to lend their voices and support to Hong Kong’s role in connecting the mainland with the rest of the world.

Commodities may be added to the stocks, bonds, options and wealth management products that are currently tradeable in the so-called Connect scheme, which allows global investors and mainland capital to tap into each other’s markets via Hong Kong, said Wu Qing, the chairman of the China Securities Regulatory Commission (CSRC), who is the point person on equities. More options and futures will also be added to the pipeline, he said.

Wu is among a coterie of mainland financial officials attending the HKMA’s flagship event in Hong Kong, led by Chinese Vice-Premier He Lifeng.

Beijing will help more mainland companies list in Hong Kong, improve mutual market access, issue treasury bonds and strengthen its position as a global offshore yuan hub, which will help the city become a stronger international financial centre and support China in opening up its economy, said He, the highest-ranking Chinese financial official to visit the city in years. He delivered a recorded speech via satellite last year.

“Once again, it is proved that with a good system of ‘one country, two systems’, the sturdy support of the country and hard work of the people, Hong Kong’s status as an international financial centre will be more prominent,” he said in his opening remarks at the conference.

The vice-premier said Beijing will support quality enterprises to list and issue bonds in Hong Kong, continue to expand mutual market access in a number of areas and improve the mechanism for the regular issuance of treasury bonds and support Hong Kong in consolidating its position as a global offshore renminbi business hub, so that Hong Kong’s financial development will be further promoted.

“Hong Kong is an open economy and internationalisation is its distinctive feature and advantage,” he said.

Wu also lent his support to Hong Kong, adding that the Connect scheme will be enhanced and expanded to help more Chinese companies tap global capital, while allowing more international investors to tap the growth on the mainland’s economy.

“The mutual market access will be expanded; we will explore more channels,” he said. “We will improve efficiency, support listing inside and outside the mainland, continue to explore mutual market access with outside markets to attract funds from all over the world.”

“We will enhance liberalisation of on market,” he added. “We want to explore more markets to satisfy the investment needs of investors, and at the same time meet risk management needs.”

More than 300 financial heavyweights gathered at the Grand Hyatt hotel in Wan Chai on Tuesday for the second day of the annual conference. The summit kicked off on Monday night with a welcome banquet at The Henderson, a new high-rise office tower in Central.

Hong Kong must prosper as an international financial centre by leveraging its global connections and support from Beijing, according to Li Yunze, the secretary of the National Financial Regulatory Administration (NFRA), who is in charge of overall financial coordination.

“We will do our job as the regulator as we faithfully implement policies and measures to support Hong Kong’s long-term prosperity and stability,” Li said on a panel with Wu.

“Hong Kong’s status as a financial centre is becoming stronger, as is [Hong Kong’s] role as a superconnector and super value-adder.”

The city is home to an array of financial services, helps bring in foreign capital and supports mainland businesses who want to go global, Li said.

Li also said the NFRA has encouraged more Chinese banks and insurers to set up headquarters in Hong Kong to promote cross-boundary collaboration.

“[Stimulus measures] are paying off,” said Zhu Hexin, the deputy governor of the People’s Bank of China and administrator of the State Administration of Foreign Exchange.

“We’re full of confidence in the mainland’s and in Hong Kong’s market, you see the same trend. In the stock market, bond market, you can see positive feedback,” he said, adding that China welcomes foreign investors.

The third edition of the summit will run until Wednesday and was sold out a month in advance, the HKMA said. Organisers will welcome more than 100 leaders of global banks, including Goldman Sachs, JPMorgan and Citigroup, beating the more than the 90 top executives who attended last year.

“The unprecedented changes in the world are accelerating,” Vice-Premier He said. “Global political and economic landscapes are undergoing profound changes, there are more variants and uncertainties. Regardless of how the external environment changes, we will focus on ourselves.”

Hong Kong should also look to new opportunities, such as fintech and becoming a family office hub, he added.

Luanne Lim, the CEO of HSBC Hong Kong, commented before the opening ceremony that it was amazing to see an official from the central government physically here to attend this event.

“It’s a big statement and show of confidence in Hong Kong,” she said.

Benjamin Hung, the president international and former CEO of Standard Chartered Hong Kong said the HKMA has put on an impressive show.

“You do not get an event like this with so many people across different fields in the industry here at once,” he said.

Delivering his welcoming remarks, Hong Kong’s acting Chief Executive Eric Chan Kwok-ki said the city should look to meaningful opportunities for growth in emerging sectors such as fintech and green and sustainable finance.

“Investors are increasingly seeking opportunities that align with sustainable development goals, and green technologies and green finance were central to that goal,” he said.

He added the government is working with financial regulators to provide a regulatory environment that is supportive of fintech innovations for a more prosperous and sustainable future.

HKMA chief executive Eddie Yue Wai-man, in his keynote address, said that while some changes are disrupting the way that we live and work, like technological or geopolitical shifts, the HKMA will focus on two things: resilience and distinguishing signals from noises.

“As a small open economy and national financial centre, Hong Kong has built strong buffers that allow us to withstand and respond to external shocks and turbulence,” Yue said.

Hong Kong has “unique value” and investors should seize the opportunities offered by a transforming China and capture the potential unleashed by digitalisation and sustainability, he added.

Hong Kong’s Financial Secretary Paul Chan Mo-po said in his keynote address that the city will remain a strong foothold for Chinese companies going global.

“Mainland enterprises require a wide range of services, support from trade financing logistics to consulting services on ESG compliance and other international regulations,” he said. Hong Kong can also the platform for managing their corporate treasury, logistics and marketing, he added.

Sentiment in Chinese markets has been shaky of late as the latest stimulus measures failed to excite investors, while the threat of higher tariffs looms after the re-election of Donald Trump as US president.

Fundraising in the city has picked up for the first time in four years with US$9.2 billion raised since November 15 from 57 initial public offerings. However, the levels are still well below those seen when more than double that amount was raised in 2019.