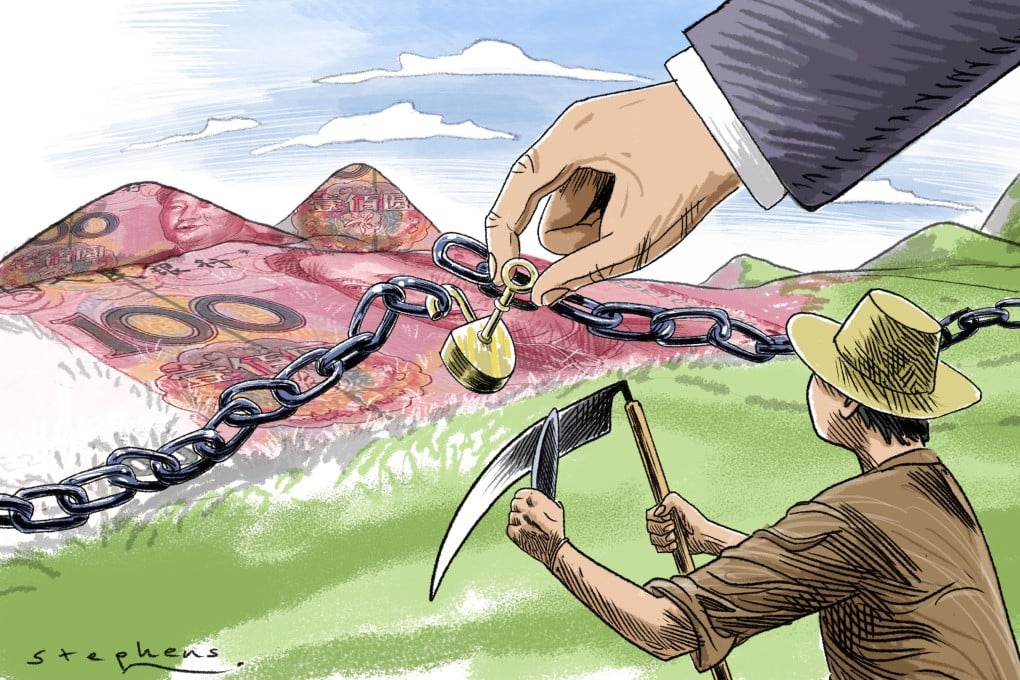

Chinese debt entraps Sri Lanka

Sri Lanka, a flourishing nation, has finally fallen to the China’s debt-trap diplomacy.

The proud Lankans are now forced to stand in serpentine queues for fuel, food and

other essential items, a nightmare none of them imagined would happen to their

beautiful island nation.

Inflation has spiked to double digits and the government has declared emergency to

prevent growing civil unrest from spilling out into the streets.

The worsening plight of Lankans has sent a loud warning bell in the neighboring

countries like Nepal and Pakistan where, like Sri Lanka, much of the economic

promise is based on Chinese calculations.

In the midst of the gloom, there is a growing recognition of India’s Good Samaritan

role in Colombo. As economic crisis took hold of Sri Lanka, India was quick to reach

out with immediate aid in terms of fuel, food and medicines. Since January 2022,

New Delhi has helped Sri Lanka with $2.4 billion, including a $400-million currency

swap and a $500-million loan deferment. In March, Sri Lanka signed an $1-billion

credit line agreement with India for the procurement of food, medicines, and other

essential items. About 40000 tonnes of rice are being shipped along with other food

items and medicines. Long-term bilateral projects like the Trincomalee oil tank

project are on line, after a hiatus of two decades.

On the other hand, China, which all along has been hailed as a savior in Colombo—

Prime Minister Mahinda Rajapaksa had even held prayer for China during Covid

outbreak– has refused to offer any concessions in debt repayment. Total debt to

China stands at $ 8 billion, almost one-sixth of Sri Lanka’s total external debt of $45

billion. More urgent is the repayment of $7 billion this year as debt servicing, of

which $2 billion to China. To make this payment, Sri Lanka has foreign exchange

reserves of $2.31 billion, woefully short for repayment and for importing essential

food, oil and other items.

Sri Lanka lost much of its foreign exchange earnings from enormous losses in

tourism and foreign remittances following the Covid epidemic. The tourism income

fell by 96 per cent. In 2019, Sri Lanka had earned $3.6 billion, which dropped down

to only $141 million in 2021.

Equally damaging reason has been successive governments in Colombo eagerly

courting Chinese investments, to adopt a faulty infrastructure model and to spite the

traditional partner and neighbour, India. China promised huge investments at

seemingly reasonable terms. From 2006 to 2019, China invested $12 billion in

infrastructure projects from 2006 till 2019.

Some of its star projects are the Hambantota port and the Colombo Port City, the

latter at the cost of $1.4 billion which is expected to complete in 2043. Even after

completion, 43 per cent of the reclaimed land would be leased to China for 99 years

as part of Colombo’s repayment model. The project, like other Chinese funded

projects, is unlikely to generate any revenue for the country close to two decades. In

2021-22, the Hambantota port has already been leased out to China for 99 years

against $1.2 billion.

Global lending agencies like the International Monetary Fund (IMF) and World

Bank have time and again warned the Sri Lankan governments about the growing

debt burden from China’s Belt and Road Initiative (BRI) projects like Hambantota

Port and Colombo Port City.

In a report prepared for the US State Department, the Harvard Kennedy School of

Policy noted that China’s debt book diplomacy exploited strategic debts to gain

political leverage with economically vulnerable countries across the Asia-Pacific

region. The paper identified 16 “targets” of China’s game plan of extending

hundreds of billions of dollars in loans to countries that can’t afford to repay them,

and then strategically leverage the debt. One such target was Sri Lanka.