Nvidia preparing to abandon $40bn Arm takeover

Nvidia is becoming increasingly resigned to giving up on its $40bn takeover of Cambridge-based chip designer Arm, as regulatory hurdles and industry opposition mounts, making it almost certain that the two-year time frame the companies aimed to complete the deal in will expire.

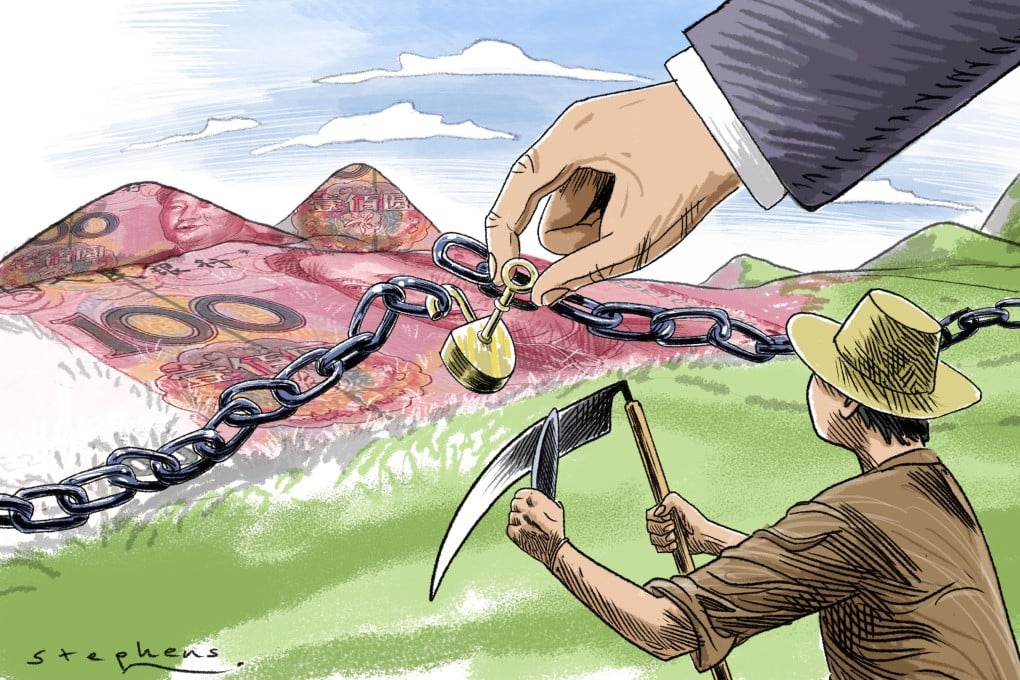

The contentious deal, the largest ever in the semiconductor industry, has become mired in seemingly insurmountable regulatory red tape on both sides of the Atlantic as well as in China since being announced in September 2020.

Executives at US-based Nvidia have reportedly expressed serious doubts that the deal will be closed, while SoftBank, the Japanese owner of Arm, has rekindled plans to float Arm as an alternative to a sale, according to Bloomberg.

Nvidia, and Arm, continue to pursue regulatory clearance while the initial deal terms are set to expire on 13 September, a date by which the parties now cannot hope to gain clearance.

“We remain hopeful that the transaction will be approved,” said a spokesman for SoftBank.

The Federal Trade Commission (FTC) dealt the most recent blow to the prospect of a successful takeover, launching legal action in December to block what it called an “illegal vertical merger” that would give Nvidia too much market power.

Despite the mounting opposition to the takeover of Arm – which many of its 500 clients, which range from Apple and Samsung to Qualcomm, say would end the company’s status as the “Switzerland” of the semiconductor industry – Nvidia continues to expound the benefits of the deal.

“We continue to hold the views expressed in detail in our latest regulatory filings,” said Bob Sherbin, spokesman for Nvidia. “This transaction provides an opportunity to accelerate Arm and boost competition and innovation.”

Arm, which employs 6,500 staff including 3,000 in the UK, declined to comment.

The increasingly severe global shortage of chips – the “brain” within every electronic device, from smartphones and cars to aviation and smart TVs – has increased takeover activity and increased scrutiny on deals in the now geo-politically sensitive sector.

In 2018, US company Qualcomm abandoned its $44bn, two-year pursuit of Dutch chip maker NXP after failing to secure approval in China, a victim of a trade dispute between Beijing and Washington.