China’s Economic Challenges

China’s economic slowdown has impacted its government with 28 of China’s 31 provincial-level governments announcing reduced growth targets and policy goals for 2022 as compared to previous years. Even the more developed regions such as Shanghai, Guangdong and Beijing targeted a lower growth rate of 5-5.5% as against 6% in the previous year.

The recent data has become a cause of concern for the post covid recovery as domestic consumption and trade have failed to bring the desired outcomes. The official claims of the economy having picked up are not matching with the weakening external demand. President Xi Jinping is particularly worried about the bleak economic outlook of the country as it may adversely impact his bid for another term at the 20th Party Congress later this year.

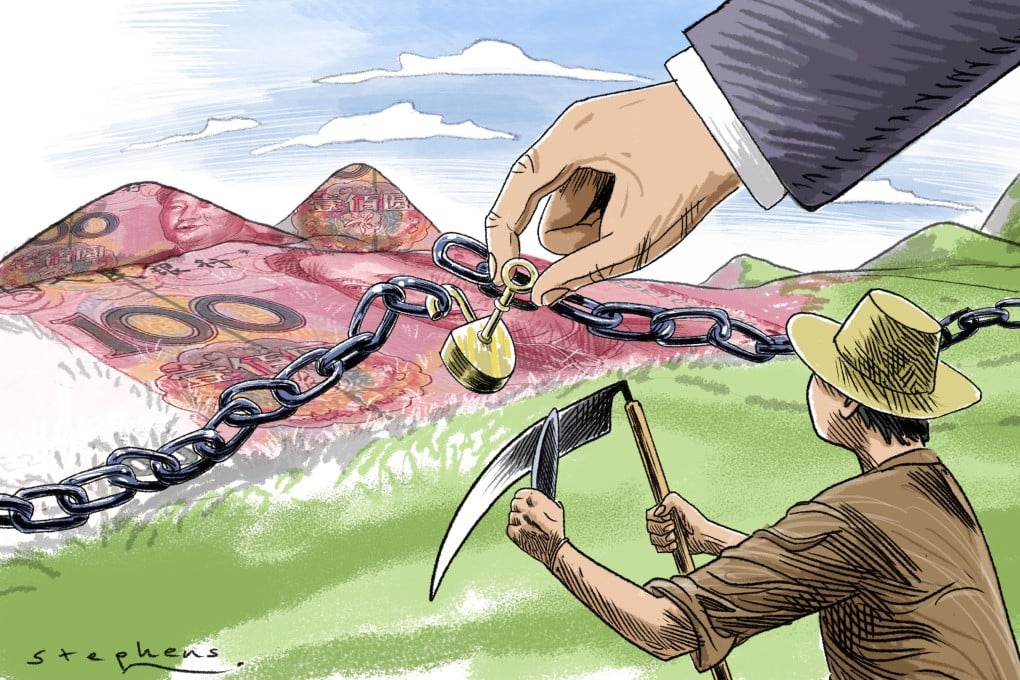

The times ahead may be tough for China due to the need for reworking and restructuring of the ruptured industrial chain caused by Covid pandemic, pressure of carbon reduction and global supply chain disruptions. Growing unemployment too, was leading to doubts regarding the government’s ability to resuscitate the economy. There was apparently unprecedented pressure on central and provincial governments as they were confronted with revenue shortages, even to maintain their routine expenditure.

Local governments across China had ordered teachers and officials to pay back bonuses. Civil service bonuses had been suspended in Shanghai, Jiangxi, Henan, Shandong, Chongqing, Hubei and Guangdong. The demand for bonus reversals indicates that the Chinese government was undergoing something of a fiscal crisis.

The fiscal health of Chinese local governments seems to have deteriorated, especially since the first half of 2020. All the provinces except Shanghai reported fiscal deficits, implying that they expended more than they earned.

Rising unemployment due to pandemic-led dislocations among the youth may dent the popularity of the Chinese government and the CPC. The situation in job market further worsened due to regulatory crackdowns on private tech companies by the government. Chinese small businesses have not recovered from the setback caused by the Covid pandemic as they had closed down or were running sub-optimally. As per official Chinese data 4.37 million of China’s small businesses closed permanently in the first 11 months of 2021.

Apart from the Covid shock, Chinese job market was also under pressure due to an ageing population and delayed recovery in the services sector. With the mismatch of supply and demand in the employment market, job opportunities for college graduates have been shrinking for quite some time. China’s Labour statistics claimed (February 4) that the number of people employed in the manufacturing industry decreased by over 10 million between 2013 and 2021.

China’s financial sector has also been adversely impacted. The China Banking and Insurance Regulatory Commission recently revealed that a total of 2459 bank outlets of commercial banking institutions had ceased operations and its four major banks including Industrial and Commercial Bank of China (ICBC), the Agricultural Bank of China (ABC), the Bank of China (BOC) and the Construction Bank were compelled to close down 187 branches and retrench 22,355 personnel.

President Xi’s declared goal of “Common Prosperity” too has created new uncertainties in Chinese business circles. Beijing has progressively tightened controls on big business and imprisoned a number of billionaires despite receiving donations from them. This may hamper the morale of entrepreneurs and consequently economic growth.

Since the external environment has also become increasingly complicated, grim and uncertain in the wake of Ukraine-Russia war and the expanding scope of sanctions on Russia, the Chinese economy may be hit harder. The Ukraine crisis could add new problems as China imports grain, soybean and hi-tech equipment from the country.