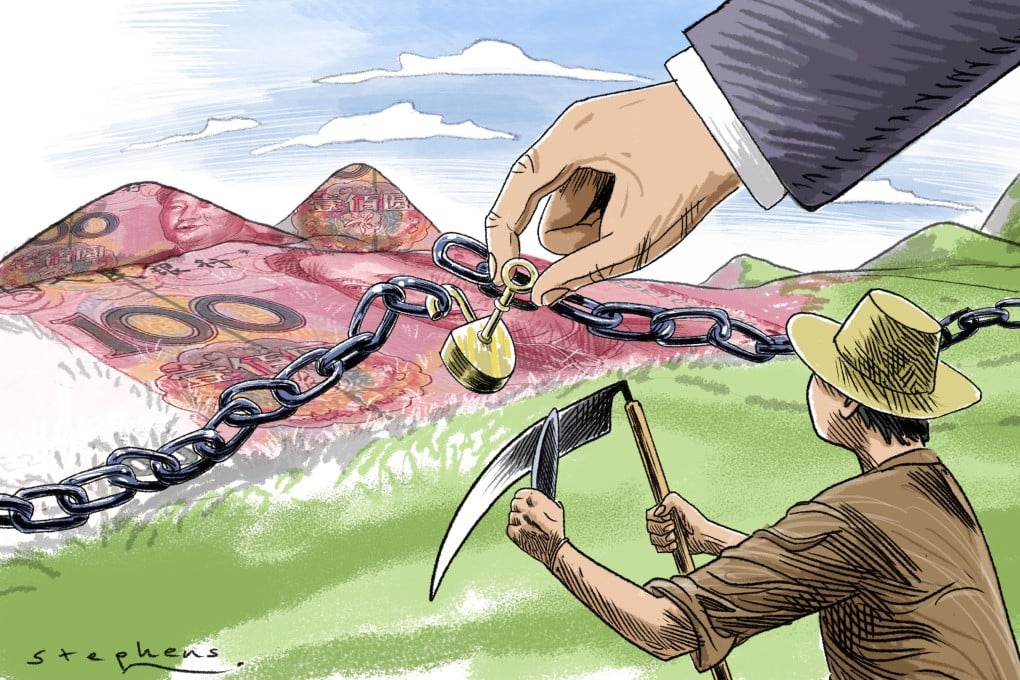

Chinese economy may struggle to achieve 5.5% growth this year

China has set the target of around 5.5 per cent for GDP growth this year, which is the lowest in the decades. The second-biggest economy in the world is facing a slowdown due to a slump in manufacturing, real estate, exports, inflation and consumer spending. The ongoing Ukraine crisis poses a risk of further damaging China’s economy. Chinese Premier Li Keqiang has warned the country of a “grave and uncertain” outlook in the wake of the Covid-19 pandemic, property slump in the country and concerns over the war in Ukraine.[1] Rising crude oil prices and hurdles in the development of the Belt and Road Initiative (BRI) are going to worsen China’s economic woes. China’s GDP had grown by 8.1 per cent in 2021. However, it would not be easy for China to even reach 5.5 per cent growth this year.

According to a survey by Beijing-based the American Chamber of Commerce (AmCham), half of the companies in China have lost significant production capacity after the unprecedented power crisis had hit the country in 2021.[2] Also, the optimism about the business outlook among companies in China has dropped from 84 per cent to 77 per cent in just one year. China’s zero-Covid policy has added to the problem as it imposed various restrictions on business operations. Even Purchasing Managers’ Index (PMI), which shows the prevailing direction of economic trends in the manufacturing and service sectors, fell to 50.2 per cent in February from 51.4 percent in January.[3] China’s economy is facing a cash crunch due to sluggish consumer demand. Money supply that includes cash and demand deposits at banks fell 1.9 per cent in January– lowest since 1997. It was triggered by a 5.3 per cent drop in corporate deposits.

Rising unemployment is another major problem China is facing as unemployment among fresh university graduates increased to 0.88 in the fourth quarter of 2021 from 0.79 in the second quarter of 2020.[5] Wang Hui, director at the Chinese Ministry of Education, agreed that the employment situation was “severe and complicated”. “At present, the production and operation of some industries and enterprises have yet to recover to the pre-pandemic level. Uncertainties persist for demand in the employment market, as the capability of absorbing employment by some of the small and medium companies has declined, and the sporadic outbreaks have also had a negative impact on the on-campus job affairs activities,” he said. The service sector that employs 47 per cent of China’s workforce is in poor shape as businesses are not hiring new workers. Even the average number of workers at big industrial enterprises reduced to 7,398 in November 2021 from 7,419 in November 2020. This has had a negative impact on the overall growth of the GDP.

China saw lower growth in overall exports in January- February 2022 as compared to December 2021. Now, the Ukraine crisis can have a serious negative impact on China exports- a key contributor to the Chinese GDP if the conflict lasts longer. China’s trade with Russia and Ukraine are valued in 2021 at USD 147 billion and USD 19 billion, respectively. The recent sanctions on Russia by the US, European Union and Canada among others will certainly impact Chinese overseas trade. Moreover, Russia and Ukraine are a part of the BRI — a mega Chinese infrastructure project. So, the current military conflict is going to stall the progress of the BRI and thus hurt the Chinese economy’s growth prospects. Chinese Premier Li Keqiang expressed concerns about risks to the BRI and sought to guard against “overseas risks”.

The surge in crude oil prices is another problem for China’s economy. Beijing will get state-owned oil refiners to reduce profits and control prices to avoid inflation. This will exert pressure on China’s monetary policy. The economic slump has forced the Beijing government to put its long-term objectives on hold and rather focus on measures to salvage the country from the current financial setback. It has also come up with stimulus package like tax relief for entrepreneurs who generate employment and relaxations in lending by banks. Analysts have predicted that it would be tougher for the Beijing government to achieve 5.5 per cent GDP growth this year. “It may be a bit difficult to achieve the target, and we need to take some measures to achieve it,” said Zong Liang, chief researcher at Bank of China.