Implicating of Chinese Economic Slowdown

The first quarter of 2022 is coming to an end but China has failed to normalise its

economy. It continues to face major economic disruptions as the resurgence of

Omicron variant of Covid-19 in many of its industrial hubs has compelled the

industries to close down including Shenzhen (the second most important port

after Shanghai) and Changchun (Jilin) which accounted for about 11% of China’s

automobile output.

Bloomberg reported (March) that 14 provinces had high or medium- risk regions,

accounting for 54.4% of national GDP. Already China was grappling with falling

real estate prices and uptick in inflation. Most economic forecasts about China

have kept its GDP estimates for 2022 between 5 and 5.5%, which is lower than

the rate required to employ the Chinese youth fully. The current woes of Chinese

economy mixed with trade dispute with the US and declining trust in China

centric supply chains may further mar its prospects.

The crackdown on tech giants like Alibaba and Tencent has resulted in these

Chinese company’s downfall in the list of world’s 10 most valuable companies,

while the number of Chinese firms worth $100 billion has also come down.

Similarly, China’s external footprint was also declining as Sri Lanka and Pakistan,

the BRI partners were facing an economic crisis with financial flow from China

apparently reduced.

China’s slowdown could alter the geo-economic dynamics which may create

alternative supply chains and new opportunities for India and South East Asian

Countries (EAC). Further, the crackdown by Chinese government on real estate,

EdTech and Technology firms has impinged on the flow of capital into these

sectors, which India and EAC could leverage and take advantage for diversifying

manufacturing. China was facing shortage of labour force and rising cost while

India and EAC still offer cheaper locations with abundant supply of labour. The

incentives offered by India under “Make in India,” and ‘Start-up India” offer

opportunities to the investors from across the world, including China. Foreign

companies can also take advantage of India’s Atmanirbhar Bharat programme

that aims at creating its own industrial ecosystem.

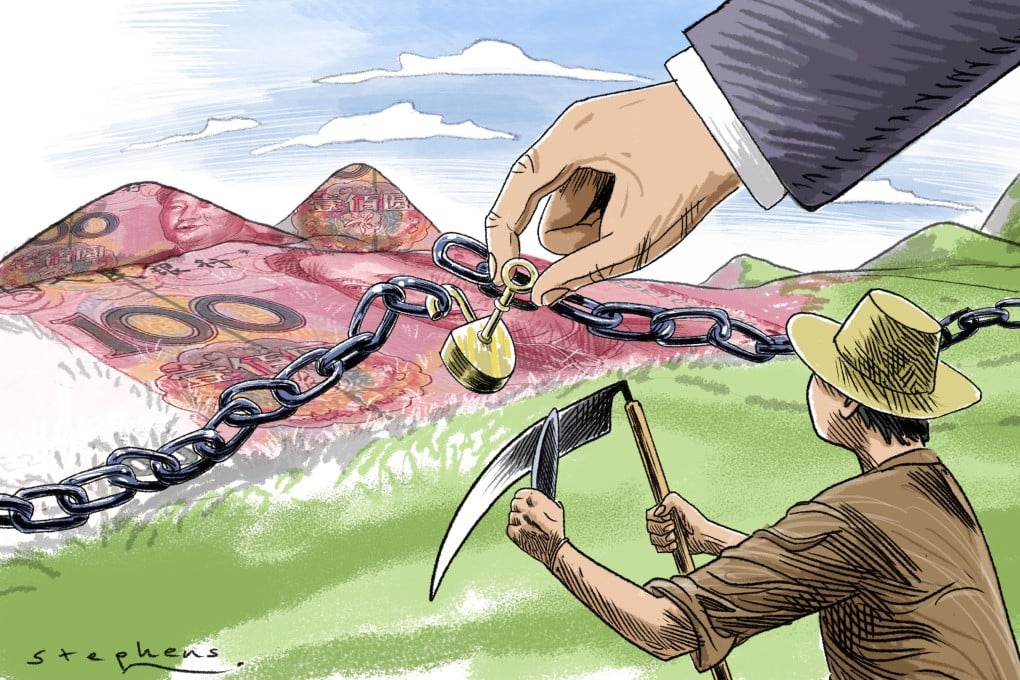

China’s access to overseas capital was also declining, since several real estate

firms including Evergrande, Shimao and Kaisa have defaulted on their offshore

bond repayments. Further, the crackdown on Alibaba and other tech majors was

making foreign investors rethink. The latest data protection law also makes it

difficult for foreign businesses to accurately assess the Chinese economic

scenario.A slowdown in the Chinese economy would also imply that global finance and

capital would look for new growth centres to invest, especially India and the SEA

countries, which have risen in reckoning as the most favoured investment

destinations in the world. The Indian economy, in particular, has pursued its

economic reforms in an uninterrupted manner during the last decade including

for improving the Ease of Doing Business. India’s emergence as as an

alternative to China is compelling because in infrastructure, transportation, mass

education, literacy, public health, e-commerce, work opportunities for women and

skilled workforce etc., India is far ahead among its peers. It is also is moving up

the value chain into R&D, innovation centers, machine learning, analytics,

product design and testing, and other areas, especially in IT and life sciences.

According to the National Association of Software and Services Companies

(NASSCOM), India exported $136 billion of IT services in 2019, with over 60 % of

this business coming from U.S. firms.

India has the potential to become an important global manufacturing hub for

those companies seeking an alternative to China. In the wake of Covid-19 and

American dependency on China for manufacturing goods, most of America’s

leading companies have either set up large technology operations in India or

continue to rely heavily on India-based IT capabilities.

India manufacturing sector has also come a long way in many sectors including

chemicals, pharmaceuticals, plastics, textiles, apparel, and steel. Now it is trying

to scale up in the value chain in newer and diverse areas, viz., mobile phones,

semiconductors, medical devices and supplies, automobile parts, batteries,

telecom equipment, food products, white goods defense production, electronics,

solar panels, and toys etc. All of these are major areas of Chinese

manufacturing which appear to be in search of new locations in view of economic

disruptions in China and rising labour cost.