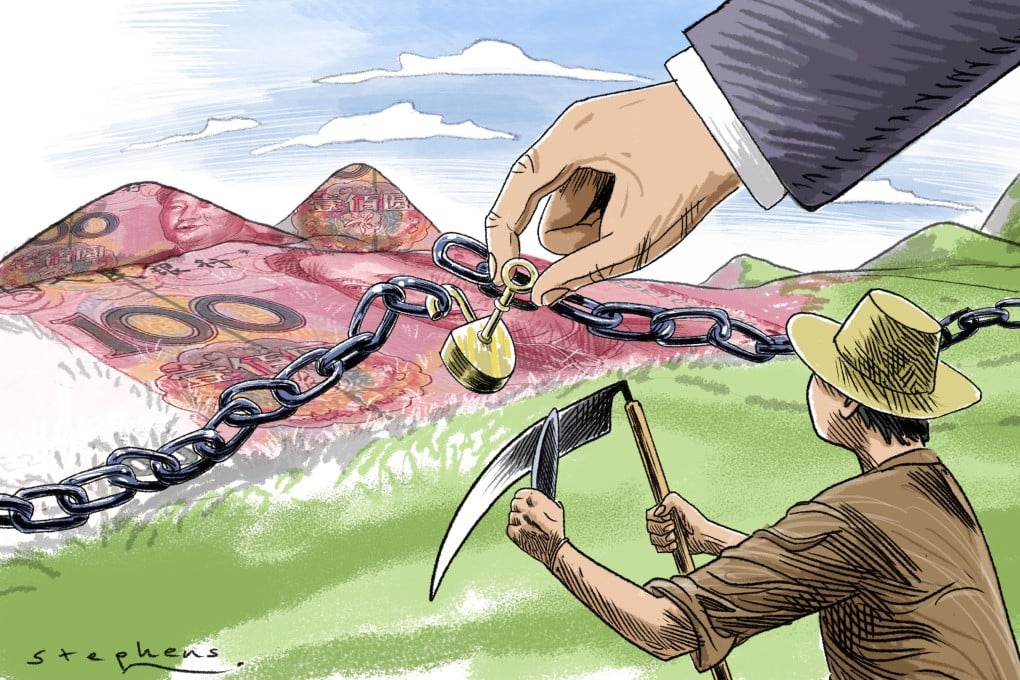

Chinese miners to Acquire Vast Lithium reserves in Afghanistan

While the world’s attention is focused on the Ukraine issue, China attempts to seize control of Afghanistan’s

substantial natural resources. Beijing has been eyeing the country’s rich natural resources since the Taliban

took power last year, and Chinese corporations are talking with the Kabul administration about mining rights

and research access.

Lithium is one of several minerals found in significant amounts that remain unexplored in Afghanistan, owing

primarily to years of political instability and a lack of infrastructure. A Chinese business obtained the rights to

mine one of the world’s largest copper deposits in Afghanistan’s Aynak region more than a decade ago but has

yet to begin mining.

Following the Taliban’s control of the war-torn country, China is eyeing roughly $1 trillion in undeveloped

mineral reserves in Afghanistan. In November of 2021, five Chinese businesses were granted special visas and

arrived in Afghanistan to undertake on-site inspections of possible lithium projects. According to Ariana News,

Esmatullah Burhan, a spokesperson for the Ministry of Mines and Petroleum, the Islamic Emirate of

Afghanistan (IEA) leadership, has reviewed the MesAynak copper project deal and found no issues.

Mining in MesAynak in Logar province, according to Burhan, will begin shortly. According to MCC estimates,

the MesAynak site has 11.08 million tonnes of copper. Meanwhile, according to Ariana News, Afghan officials

claim that China is more interested in Afghanistan’s mining industry than any other country.

With the exit of the United States, Beijing can provide Kabul with what it most desperately needs: political

neutrality and economic investment. On the other hand, has what China values most: prospects for

infrastructure and industrial development — sectors in which China’s skills are probably unrivalled — and

access to $1 trillion in undeveloped mineral reserves.

In the Great Game, the Russian and British empires fought for Afghanistan throughout the nineteenth century.

Afghanistan’s strategic position and capacity to influence South Asia were recognised in the geopolitical

struggle. After capturing Kabul in August 2021, the Taliban gained control of Afghanistan, causing the

government of Ashraf Ghani to collapse and massive evacuations.

Through President Xi Jinping’s centrepiece Belt and Road plan, China is the world’s largest mineral consumer

and a long-term investor in several of its Asian neighbours. Beijing has proven a readiness to invest in some

of the world’s most turbulent areas, like Africa and South America, to safeguard its commodity supply.

According to Alokozay, the Taliban regime supports China’s interests. The militant group has been looking for

outside help to save the country’s economy in freefall since it took power in August. He said that efforts to

enhance commerce between the two countries were also addressed. Representatives of numerous Chinese

businesses visited the nation in early November to perform on-site inspections of possible lithium mines and

investigate additional commercial prospects, according to China’s Communist Party-owned newspaper Global

Times.

Tianqi Lithium Corp. and Ganfeng Lithium Co., China’s two largest lithium producers, said they had no

information on the alleged trips. China has yet to acknowledge the Taliban, but it is strengthening connections

with its government and has offered to assist in its reconstruction. Beijing is eager to increase its regional clout

and prevent extremists and migrants from expanding beyond Afghanistan’s borders. Contracts to exploit

Afghan mineral reserves have already been signed by Beijing. Investors led by the state-owned Metallurgical

Corp. of China Ltd. won a bid worth over $3 billion to extract copper at the MesAynak mines near Kabul in

the mid-2000s, but little progress has been achieved.

Officially, Afghanistan’s economy has increased as billions of dollars in aid have poured in. According to

recent research from the USA, Special Inspector General for Afghanistan Reconstruction, this increase has

varied with donor support, demonstrating “how artificial and hence unsustainable the rise has been.”

Investors headed by the state-owned Metallurgical Corp. of China Ltd. won a nearly $3 billion bid to mine

copper in MesAynak, near Kabul, in the mid-2000s.MCC said in its 2020 annual report that it was in

negotiations with the Afghan government over the mining contract, despite having previously stated that the

project was economically unviable. It has yet to produce anything due to a series of delays ranging from

security concerns to the discovery of historical treasures, and there is still no rail or power plant.

The Taliban is attempting to demonstrate that it has evolved since its repressive control in the 1990s by stating

that it welcomes international investment from all nations and would not allow militants to use their base as

Afghanistan. JananMosazai, a former Afghan ambassador to Pakistan and China who entered the private sector

in 2018, sees “enormous prospects for the Afghan economy to take off” if the Taliban demonstrate their

commitment to “living the talk.”