EU warns Elon Musk that Twitter must stick to digital rules – as it happened

7d ago 21.17 Twitter shares have ended the day down 3.9% at $49.68 each, as the gap to Elon Musk’s agreed takeover offer widened. Tesla kept sliding, and has closed 12% lower at $876, amid concerns that Musk might need to sell billions of dollars’ worth of shares in the carmaker to fund the deal.

7d ago 21.14 Wall Street tumbles Ouch. The Nasdaq Composite has closed at its lowest level since December 2020, in its worst session since September 2020. The tech-focused Nasdaq shed almost 4%, as fears over rising interest rates and slowing global growth hit Wall Street. It’s lost more than 20% so far this year, as inflationary worries hit growth stocks. Nasdaq 100 Total Returns…

2009: +55%

2010: +20%

2011: +4%

2012: +18%

2013: +37%

2014: +19%

2015: +10%

2016: +7%

2017: +33%

2018: +0.04%

2019: +39%

2020: +49%

2021: +27%

2022 YTD: -20%$NDX — Charlie Bilello (@charliebilello) April 26, 2022 The broader S&P 500 also had a rough day, sinking by 2.8%, while the Dow Jones Industrial Average of 30 large stocks shed 809 points, or over 2.3%. As well as the tech sector, there were losses among companies reliant on discretionary consumer spending, communications firms, financial stocks and industrial companies.

7d ago 20.56 Journalist Jon Ronson, who has spent many years investigating and reporting on conspiracy thories, fears ‘free speech absolutism’ will lead to a flood of misinformation on Twitter: Watched @elonmusk’s fascinating conversations with @TEDchris. EM talked a lot about how he’s pathologically interested in “the truth”. I’d love to know how that tallies with his free speech absolutism. Won’t Twitter soon be flooded more than ever with things that aren’t true? — jon ronson (@jonronson) April 26, 2022 The libertarian counterargument, I think, is that false claims would be called out and exposed. But experience suggests that untrue or misleading content is propagated and reinforced within groups. Algorithms then feed people more of this content (as that’s what they’re interested in), ultimately giving it credibility and leading people to share it (etc etc).

7d ago 20.45 It’s been a rather gloomy day in the tech space, with the Nasdaq Composite now sliding by 3.5% in late trading…. Tech stocks are plunging

7d ago 20.10 Schumer: I hope Twitter doesn’t get any darker under Musk US Senate Democratic leader Chuck Schumer says he hopes Twitter doesn’t become an even ‘darker’ place under Elon Musk’s control. Asked about Musk’s purchase of the social media company, Schumer gave a sobering verdict on the platform, telling reporters: On Elon Musk I would say, look, in many ways Twitter has been a dark, dark place. I hope it doesn’t get any darker. .@SenSchumer on @elonmusk buying @Twitter: “I would say, look, in many ways Twitter has been a dark, dark place. I hope it doesn’t get any darker.” pic.twitter.com/GNzzYaEAnz — CSPAN (@cspan) April 26, 2022

26 Apr 2022 19.49 WHO warns of dangers of health misinformation Since the start of 2020, the Covid-19 pandemic has shown the importance of reliable, trustworthy information online, and the risks created by false claims. And one World Health Organization official has today warned of the dangers of health and vaccine misinformation on social media, Bloomberg reports: Misinformation costs lives, Mike Ryan, executive director of the health emergencies program at the WHO, said Tuesday in response to a reporter’s question regarding the offer from Musk, a self-described free-speech absolutist, to buy Twitter for about $44 billion. “When anyone reaches a position in life where they have so much influence over the way information is shared with communities, they take on a huge responsibility,” Ryan said at the media briefing in Geneva. “We wish Mr. Musk luck with his endeavors to improve the quality of information we all receive.” Ryan added that in the pandemic, good information is life-saving while “bad information sends you to some very bad places”. More here. “In the case of this pandemic, good information is life-saving,” a WHO official said in response to Elon Musk buying Twitter https://t.co/bmmjQo0Yc2 — Bloomberg (@business) April 26, 2022 A report from the Center for Countering Digital Hate (CCDH) last year showed that Facebook, Google and Twitter had all failed to satisfactorily enforce policies against vaccine misinformation. Just 12 people were responsible for a majority of Covid-19 anti-vaccine misinformation and conspiracy theories, CCDH found. Majority of Covid misinformation came from 12 people, report finds Read more

26 Apr 2022 19.19 Moody’s could downgrade Twitter over Musk deal Rating agency Moody’s have put Twitter’s credit rating on review for a possible downgrade. Moody’s is concerned that Elon Musk’s $44bn leveraged buyout would materially weaken Twitter’s ‘credit metrics’, due to the $12.5bn of extra debt which will be added to its balance sheet. Twitter is currently rated as Ba2 by Moody’s, the second-highest junk (or non-investment grade) rating. Moody’s Places Twitter’s Ba2 Ratings On Review For Downgrade Following Agreement To Be Acquired By Musk For $44 Billion$TWTR — OnlyOptionsTrades (@OnlyOTrades) April 26, 2022 The review will focus on the new capital structure and its impact on credit metrics and cash flow. It will also consider Musk’s strategic changes to the social media platform, and whether it will have financial flexibility to grow. Moody’s says: Musk cited strategic objectives as part of his offer, including: “global free speech as a societal imperative for a functioning democracy;” “platform health and improving the signal-to noise ratio;” and “revamping Twitter Blue and exploring other non-advertising initiatives.” Moody’s believes that any success in improving the company’s operations and diversifying the company beyond its heavy reliance on advertising, from which it generates about 89% of revenue, would be credit positive. Twitter’s governance risk is moderately negative (G-3). The company’s present management and board of directors have a track record of sustaining moderately conservative financial policies. However, the company faces challenging regulatory and political relationships, exhibits weak transparency and has no stated credit metric targets. Elon Musk plans to acquire all of Twitter and take the company private, making Musk the only shareholder. It is unclear what impact, if any, this will have on Twitter’s operating policies, but given the committed financing package, the company’s financial policies will be more aggressive and with a single shareholder, there is greater risk associated with a controlled board. Moody’s has placed Twitter’s $TWTR Ba2 credit rating on review for a downgrade following Elon’s deal to acquire the company — Stock Market News (@StockMKTNewz) April 26, 2022

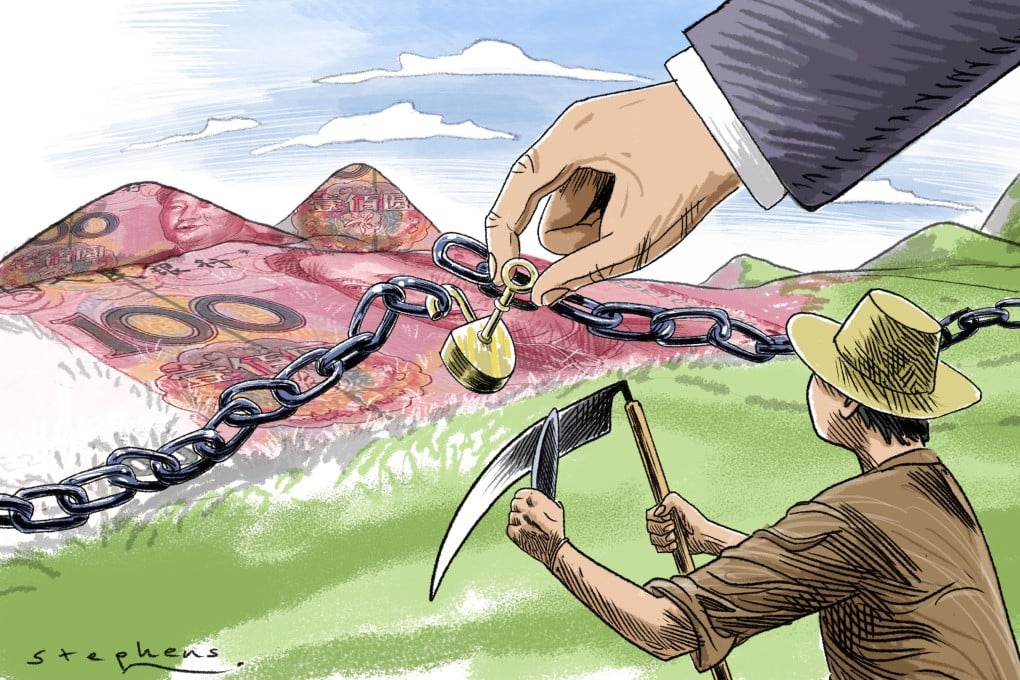

26 Apr 2022 19.03 Elon Musk’s takeover of Twitter is at best a distraction for Tesla (-11%), and at worst a real business risk, our financial editor Nils Pratley writes: One obvious risk is sales of Tesla stock by Musk to fund the $21bn equity portion of the $43bn Twitter takeover package. Another is spill-over political effects, in the US and elsewhere. Jeff Bezos, another tech tycoon turned media owner, referenced the latter mischievously. “Did the Chinese government just gain a bit of leverage over the town square?” tweeted Amazon’s founder. Twitter is blocked in China because the social media company, rightly, refuses to bow to Beijing’s security laws on what can be said about, say, the strangulation of democracy in Hong Kong or the persecution of Uyghur Muslims. But Musk, wearing his Tesla hat, is a beneficiary of Chinese largesse in the form of financial incentives to build cars in China. Rich Chinese consumers are also big buyers of Teslas and key kit for the batteries comes from the country. What would happen if Beijing were to suggest that Twitter might wish to give the Chinese Communist party an easier ride in the interest of smooth commercial relationships for Tesla? Chinese officialdom, one suspects, won’t distinguish between Musk’s ownership of Twitter (100%, if everything proceeds) and that of Tesla (17% currently). Bezos’s answer to his own question was that “the more likely outcome in this regard is complexity in China for Tesla, rather than censorship at Twitter”. The first part of that guess should still sound scary to the car company’s shareholders. In extremis, would a “free speech absolutist”, as Musk describes himself, be prepared to close factories rather than concede an inch to Chinese bullies? Here’s the full piece: Tesla shareholders are forgotten constituent in Elon Musk’s Twitter deal Read more

26 Apr 2022 18.32 Tesla’s shares are now down 11%, as some traders ponder whether Musk might have to sell some of his stake to fund the Twitter deal (see earlier post). That knocks around $100bn (or two Twitters!) off Tesla’s market capitalisation. IMHO $TSLA falling on trader /shorts speculation fueled by the media that Elon will have to sell some TSLA shares to come up with $21B equity for $TWTR deal since he gave no detail on how he would raise the $21B in his revised 13D filing last night. Doesn’t make it true. pic.twitter.com/U6wWHCCr46 — Gary Black (@garyblack00) April 26, 2022 There’s also the possibility that Musk could be distracted from his duties at the electric car company once he has Twitter to deal with. Plus, $12.5bn of the $44bn takeover deal is in loans secured against his Tesla stock. If you’re wondering why Tesla is down today, I guess the market has a dim view on the potential for forced selling of around 6-10% of outstanding float by its largest shareholder if we return to May 2021 prices. — Lily (@nope_its_lily) April 26, 2022

26 Apr 2022 16.56 Scott Kessler, global lead analyst for TMT sector companies at research firm Third Bridge, suspects there could be job losses at Twitter after the deal. Elon Musk’s push for ‘free speech’ could mean less content moderation, Kessler points out, although that could also scare off advertisers. Also, Musk may need to use Twitter’s cash flow to service the debt he’s using to partly fund the deal. Kessler explains: Yesterday’s press release indicated that Musk would use more than $25bn in debt and margin loan financing to buy Twitter. It already has $6bn in debt. However, the company generated only around half a billion dollars in adjusted free cash flow over the past three years combined. Last year Twitter generated negative adjusted free cash flow of more than $350m. Pre-pandemic, in 2019, the company generated less than $800m in adjusted free cash flow. This suggests that Musk may look to layoffs to help generate cash flow.

Twitter has some 7,500 employees, and prioritizing free speech and open source algorithms could lead to considerable layoffs, especially around content moderation efforts. Musk would be able to build out his vision and save money at the same time. Experts we’ve spoken with have indicated that the health and safety initiatives within the company have taken up considerable resources. However, the potential importance of cash flows could cause Musk to be less aggressive in terms of shifting Twitter’s business model from advertising to subscriptions. Nonetheless, less content moderation may prompt advertisers to pause or reduce their spending on Twitter.