China’s economy in the sliding slope

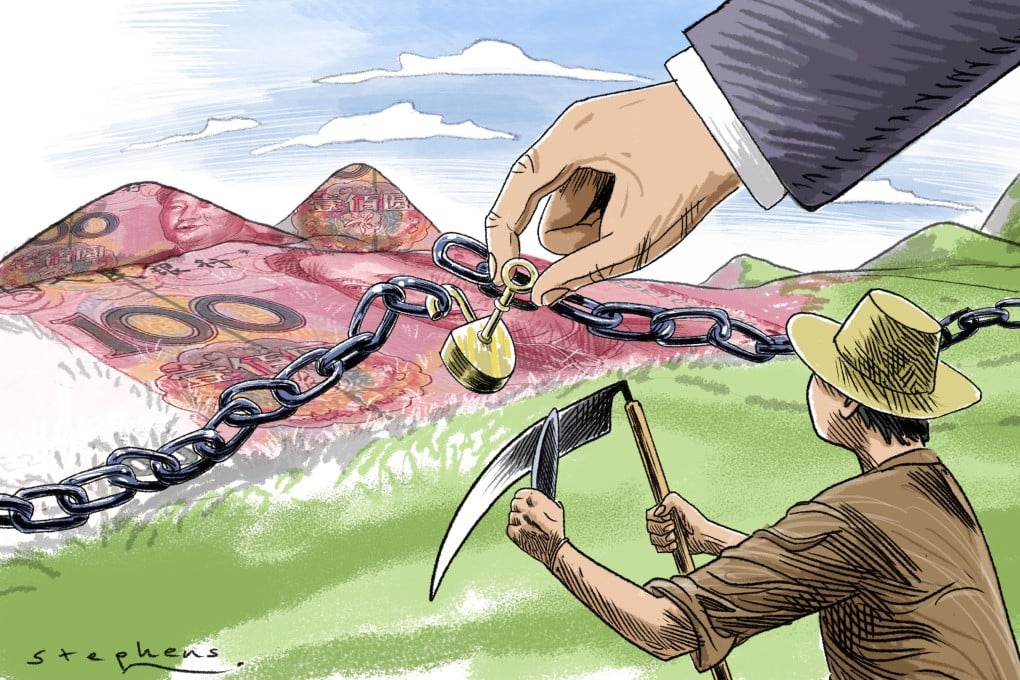

Local governments’ budget deficits have been growing as a result of rising spending and a slump in land sales and tax revenues, partly down to China’s zero-Covid policy and moves to aid under pressure businesses.

Regional authorities have also begun to aggressively acquire land through local government financing vehicles (LGFVs), raising concerns that they are using debt to inflate government revenues.

LGFVs were created to aid off-budget financing, especially for infrastructure spending, but disclosure requirements are weak in China, which adds to wariness over the risks of so-called hidden debt.

Things that can’t last, won’t. In our view, land purchases by LGFVs could strain their cash flows and increase leverage Laura Li

But despite the problems faced by public finances, LGFV land purchases among China’s top-100 land buyers rose sharply in the first nine months of 2022 to more than 200 billion yuan (US$28 billion), compared to a 51 per cent decline in total land spending by the top-100 land buyers over the same period, according to industry body, the China Real Estate Information Corporation.

“We believe LGFV land grabs are aimed at softening the fall in land sales revenue, at least on paper. Property-related revenue is a key income source of local governments, representing around 30 per cent of their revenue before 2021,” said S&P Global Ratings credit analyst Laura Li in a research report on Monday.

“Things that can’t last, won’t. In our view, land purchases by LGFVs could strain their cash flows and increase leverage, particularly if the land is sitting idle with no visibility on returns. A lot of the purchasing is taking place in lower-tier cities, or areas with weaker property markets, intensifying the risks.”

Li also noted that some transactions may involve LGFVs purchasing land by financing through debt with the expectation that they will subsequently receive refunds from local governments.

According to S&P Global Ratings, in the city of Wuxi in the eastern Jiangsu province, LGFVs took 65 per cent of 48 land parcels sold in the first nine months of 2022, accounting for a total of 29.7 billion yuan (US$4.2 billion) out of the city’s total 44 billion in revenue from land sales.

One LGFV in Wuxi spent the equivalent of 39 per cent of its total assets on land purchases, S&P said.

Analysts believe that the recent land purchases by some local governments prompted the Ministry of Finance to publish a directive last month requiring regional authorities to end “the artificial inflation of their land concession revenue” while reiterating that LGFVs should not be using debt to finance land purchases.

“We believe the rapidly declining land concession revenue could have encouraged the practice, which has significantly strained many local and regional governments’ financial positions and widened the funding gap of the capital deficit,” Fitch Ratings said last week.

The Ministry of Finance has demanded that state firms and LGFVs with no imminent intention of developing the land will no longer be able to acquire parcels, although those with a “legitimate operational need” may continue to participate in auctions.

But it may be open to interpretation because authorities have not yet provided a publicly available definition of a so-called legitimate operational need, Fitch Ratings added.

The outlook for local government finances is also likely to deteriorate, according to two reports this month by the National Institution for Finance and Development (NFID), a Beijing-based think tank.

Revenues from land sales took a steep plunge in the third quarter of 2022, and out of 31 of mainland China’s provincial-level jurisdictions, only the northwest Gansu province recorded growth, according to NFID.

The impact of the Covid-19 outbreaks has had a negative impact on both the fiscal revenue and expenditure, and local governments are under increasing pressure to maintain necessary expenditure NFID

Even the revenues for wealthy regions, including Guangdong and Shanghai, are under pressure, NFID said, with Shanghai’s budget turning from surplus to deficit in September.

The think tank said the Ministry of Finance has already stepped up its debt supervision since the start of the year, but as a result of increased spending to steady employment and controlling the spread of coronavirus outbreaks, local governments are struggling.

Nationwide revenues from land sales between January and September reached 3.85 trillion yuan (US$544 billion), but based on estimates that annual land transfer fee revenues in 2021 were around 8.7 trillion yuan, only 45 per cent of the annual budget for 2022 has been reached, NFID said.

“The impact of the Covid-19 outbreaks has had a negative impact on both the fiscal revenue and expenditure, and local governments are under increasing pressure to maintain necessary expenditure,” NFID added.

The think tank said the widening gap between local government revenues and expenditures may increase debt repayment risks in the coming months.

The deterioration of land sales has further increased the pressure on debt, especially in provinces and cities that are highly dependent on land Sinolink Securities

“The current estimated hidden debt of local governments is about 30 to 50 trillion yuan, which has declined since the deleveraging measures in 2017. However, due to the restriction to create new hidden debts, the source of funds for local governments is also more limited,” the NFID added.

Sinolink Securities said last month that net financing in the form of LGFV bonds in listed markets in the first three quarters dropped by more than 30 per cent year on year.

Western provinces, such as the Guangxi Zhuang autonomous region, the Inner Mongolia autonomous region and Gansu, and the northern municipality of Tianjin have continued to suffer from a shortfall in net financing in the listed market, Sinolink Securities added.

“Some areas with high debt repayment pressure, high dependence for land revenue, and deteriorating cash flow may face higher tail risks. The deterioration of land sales has further increased the pressure on debt, especially in provinces and cities that are highly dependent on land,” Sinolink Securities said.