THE WEST IS CATCHING UP TO CHINA IN THE MINERALS RACE

Only ten months ago, François-Philippe Champagne, Canada’s minister of

industry, approved Zijin Mining Group’s purchase of Canadian miner Neo

Lithium on behalf of the Chinese government. Champagne dismissed

worries about national security and reassured critics that Neo Lithium is “truly

not a Canadian firm” by mentioning the company’s holdings in Argentina.

Chinese miners could have seen the agreement as a favourable indication

that allowed them to continue buying Canadian minerals unhindered. Their

joy would prove to be fleeting.

In a shocking turn of events, Ottawa declared on October 28 that acquisitions

pursued by foreign state-owned companies in Canada’s crucial minerals

industry would henceforth “be allowed on an exceptional basis.”

Three Chinese companies were ordered by Champagne to sell their holdings

in three Canadian lithium mines, including two that are located in Argentina,

a week later.

The sudden action reflects a negative attitude toward Chinese mining

investment. It hasn’t always been like that. For years, Western nations have

neglected the effects that crucial raw resources have on national security,

handing over enormous mineral riches to China just as the green revolution

was getting started.

In 2013, Tianqi Lithium outbid its American opponent and acquired the

Australian Greenbushes mine, which contains the highest quality lithium

resources in the world. This acquisition was made possible by funding from

the China Development Bank.

Under the direction of the then-President Sebastián Piera, who sought to

increase private investment in the mining industry, the same company later

purchased a 24 percent share in SQM, Chile’s largest lithium producer, in

2018. Without raising any red flags during the Obama or Trump

administrations, a Chinese business acquired two of the largest cobalt mines

in the world from the American corporation Freeport-McMoran in the

Democratic Republic of the Congo.

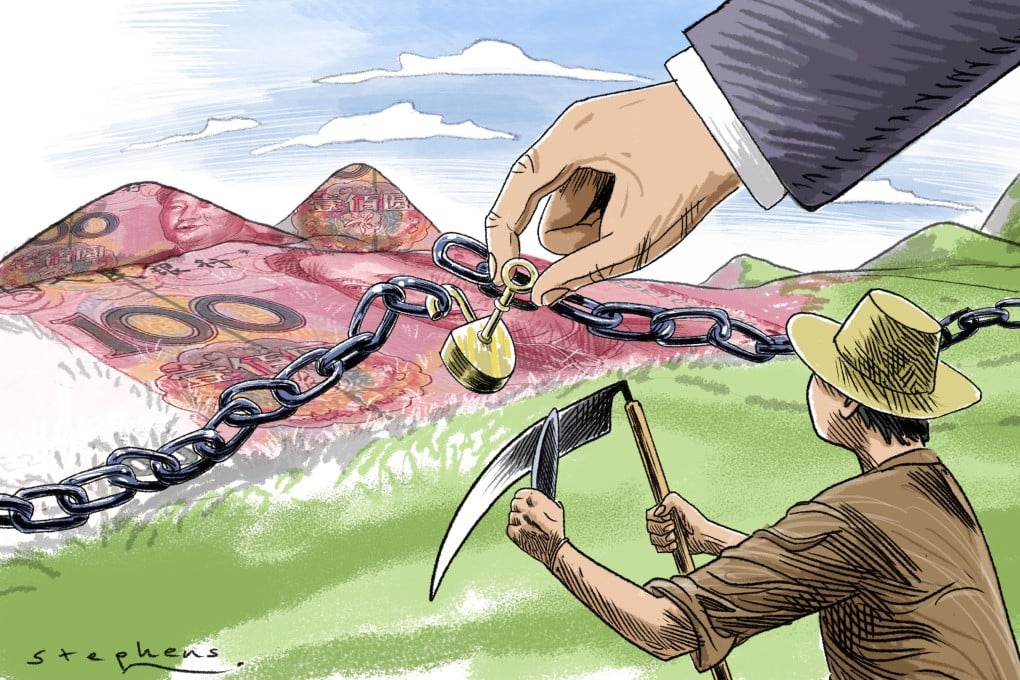

Such carelessness has allowed China to control the supply of the minerals

required for EV batteries, which are essential for the transition to clean

energy and the battle against climate change. The West must transfer raw

resources to China for processing because it lacks the ability to refine.

China is anticipated to produce 74% of the world’s batteries in 2022, with

production in Europe and the US trailing behind at 16% and 7%, respectively.

As it became increasingly difficult to ignore China’s dominance in the global

battery industry, mineral security was once again brought to the attention of

Western governments.

The Russian strike on Ukraine has reaffirmed the worry about potential

supply chain disruptions. Ukraine, which produces almost half of the world’s

semiconductor-grade neon, has halted manufacturing of neon due to theconflict. In the meanwhile, Russia exports 15% of the world’s nickel and 21%

of the palladium, which are used in batteries and catalytic converters,

respectively.

Concerns over potential penalties on Russian commodities in February

drove nickel prices to an 11-year high (the price has since fallen).

Dependence on Chinese resources is not only financially unattractive but

also jeopardises the West’s strategic independence given the geopolitical

competition between China and the West.

Governments have been pushed by these concerns to reconsider their

industrial policies, with the United States setting the standard. The Minerals

Security Partnership, which includes Australia, Canada, South Korea, Japan,

and other partners, was introduced by the State Department in June. In order

to lessen reliance on China and Russia for minerals, metals, and energy, it

is intended to strengthen the “friend shoring” of crucial resource supply

chains.

The Defense Production Act’s purview is being widened by Congress to

include support for “the technical and industrial bases of” Canada, Australia,

and the United Kingdom.

The Critical Raw Materials Act was implemented in September by the EU,

which also rejected the conventional wisdom of free trade. Champagne

echoed a notion that is common throughout democracies when he defended

the divestment by saying that Canada preferred “foreign direct investments

from partners that share our interests and values.”

Despite the high rhetoric, each nation will experience decoupling at a

different rate. Consider Australia, which has historically provided China with

lithium and iron ore.

In 2021, following the diplomatic conflict over the origins of COVID-19, the

value of Chinese investment in Australia plummeted by 69 percent,

according to research by the University of Sydney and the consulting firm

KPMG. By increasing its mineral exports to Vietnam, South Korea, and

Japan while decreasing its mineral exports to China, Australia has also

diversified its international trading relationships. However, Australia hasn’t

been able to completely reverse Chinese investments. The resources

minister of that country declined to demand that China sell its stake in lithium

mines at the International Mining and Resources Conference last week,

saying that the projects “will continue as they are.”

In the hunt for essential minerals, the West has a fair opportunity to overtake

China. China owes its competitive advantage to a range of official

assistance, including subsidies for domestic processing facilities and policy

bank funding for buyouts overseas. The United States and Europe provide

their investors with equal access to financing and enable their firms to grow

fast by combining industrial policy and investment screening. That

represents a positive beginning step.