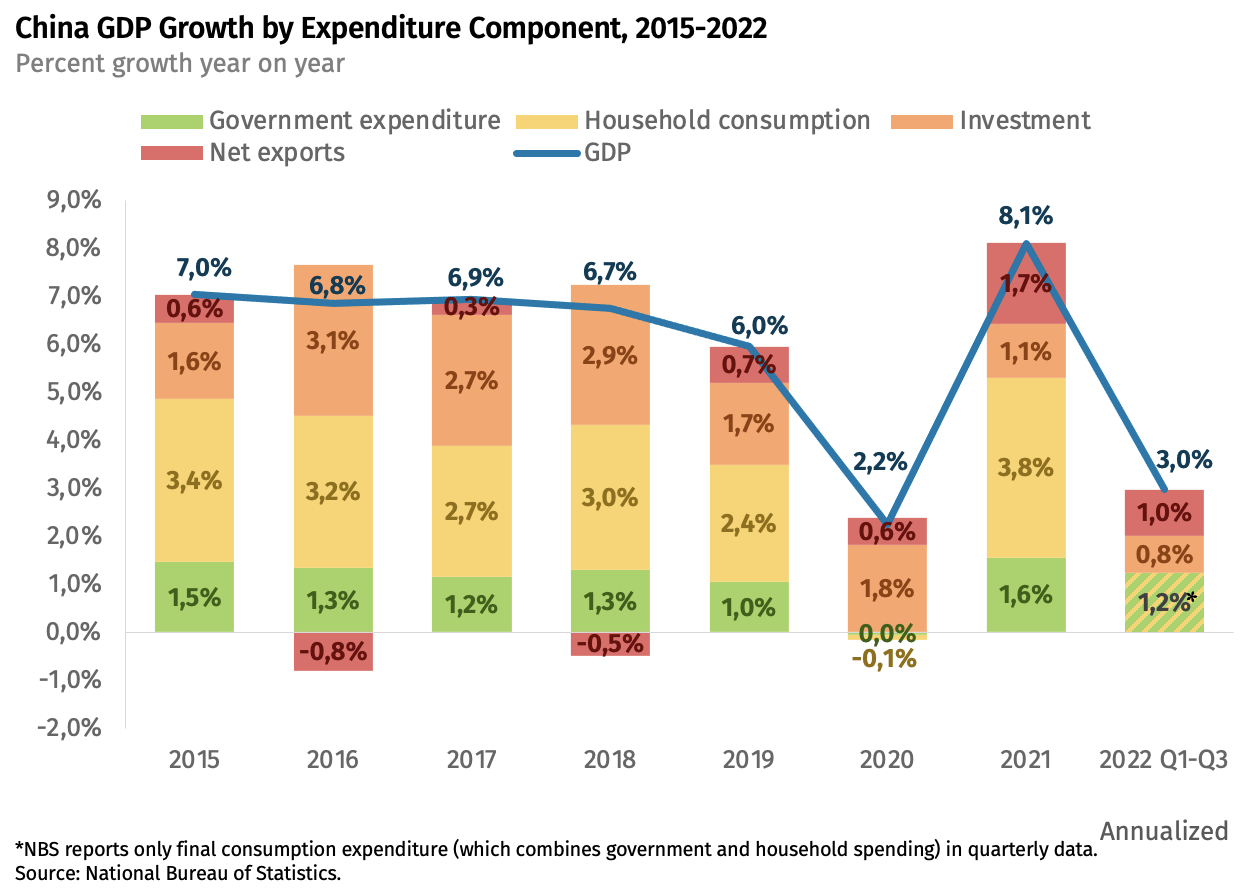

Economic Activity in China to Slow Significantly in 2023

The sudden end of the zero-Covid policy in December had raised hopes for a shallow economic recovery in China. However, households’ deteriorating confidence coupled with the unresolved difficulties in the housing sector have weighed on the growth rebound. Preliminary economic data in February indicate overall growth is not yet roaring back. Turnover in freight transport is still down from a year ago. New home sales remained below last year’s levels, mostly dragged down by falling sales in mid-sized cities, and weighing on construction activity. The unemployment rate is still high which keeps household confidence weak. It is likely that China will see a trade deficit in 2023, dragging down GDP growth and depressing profits and employment in the manufacturing sector. There is clear message that markets should not be too bullish about Chinese growth this year

A shrinking working-age population will increasingly weigh on China’s growth. China’s demographic issues, which could take decades to resolve, make the economic downturn hard to reverse. The country’s working-age population shrank for consecutive nine years from 2012 to 2020. Population aged 16–59, although rebounded slightly in 2021, declined again in 2022 by 6.66 million. More and more Chinese enterprises complained that it is not easy to recruit workers nowadays. Just a few days after the Chinese New Year, local governments in some coastal provinces such as Guangdong, Zhejiang, Jiangsu, and Fujian have already organized enterprises to recruit workers across provinces. For example, on February 2, recruiters were seen in long queues waiting for job seekers in Haizhu District, Guangzhou City, Guangdong Province.

The property market in China is so depressed that some banks are resorting to drastic measures, including allowing people to pay off mortgages until they are 95 years old. Some banks in the cities of Nanning, Hangzhou, Ningbo and Beijing have extended the upper age limit on mortgages to between 80 and 95. People aged 70 can now take out loans with maturities of between 10 and 25 years. A branch of Bank of Communications in Beijing has allowed borrowers as old as 70 to take out home loans lasting 25 years, which means the upper age limit on its mortgages has been lifted to 95. Separately, a branch of Citic Bank in the city has extended the upper age limit on its mortgages to 80. Other than Beijing, some banks in Nanning, the provincial capital of Guangxi province, have raised the upper age limit on mortgages to 80. In the eastern cities of Ningbo and Hangzhou, several local lenders are advertising age limits of 75 or 80, a relaxation from previous rules.

In the medium-to-long term, the Chinese economy could move into a downward spiral due to demographic headwinds and declining productivity. The International Monetary Fund (IMF), although expecting China’s economy to rebound in the short term, revised its medium- term growth forecast on February 3, with the GDP growth forecast being lowered to 3.8% in 2027, compared to its previous projection of 4.6%. Such a downward trend will be expected to remain in 2025–2027, reflecting the persistent economic challenges in China. According to the IMF, productivity growth remains weak, in large part because of the role of low- productivity state-owned enterprises (SOEs) and declining business dynamism.

The Asian Development Bank (ADB) made a longer-term forecast in its report published in December 2022, predicting a gradual decline in China’s economic growth from an average of 5.3% in 2020–25 to an average of 2% in 2036–40. According to the ADB, the contribution of total factor productivity to growth is estimated to be smaller in the next two decades because of a much smaller contribution from the sectoral labour shift and lower returns to R&D. The speed of migration from agriculture into industry and services is expected to moderate over time as the share of the workforce employed in agriculture has already fallen substantially.

If China’s recovery falls short of people’s expectations or some financial risks escalate, overseas investors will shy away from Yuan assets. Investors will also become more reluctant to diversify their portfolio toward emerging markets including China if the Federal Reserve continues to hike rates. Even with Beijing abandoning zero-Covid and easing its tech crackdown, foreign investors might find it difficult to return. The White House is working to create a screening process for American capital flowing into China, in an effort to reduce the flow of money from US investors to Chinese companies or sectors that help the People’s Liberation Army. The recent disappearance of Bao Fan, a renowned investment banker in China, has again raised concerns that Beijing’s crackdown on the country’s business elite is continuing. COVID-19 still remains a variable. It’s a potential X-factor that could continue to jeopardize China’s economic recovery, in addition to its public health system.