China’s Politburo Likely to Shift Focus From Stimulus to Reforms

With China’s economic recovery well on track, top leaders will likely turn their policy focus now to boosting business confidence, increasing jobs and strengthening the property market without adding extra stimulus.

The April meeting of the Communist Party’s Politburo, the top decision-making body headed by President Xi Jinping, typically focuses on the economy and sets the tone for policies in coming months. There isn’t an exact date for the meeting, but it’s likely to take place this week.

Economists are watching closely for signals around monetary and fiscal support now that growth is rebounding. Several major banks have raised their China growth forecasts for the year to close to 6% or higher, well above Beijing’s target of around 5%, reducing the need for more stimulus.

Optimism Growing on China’s Economy Economists raise forecast on 2023 growth after stronger-than-expected 1Q

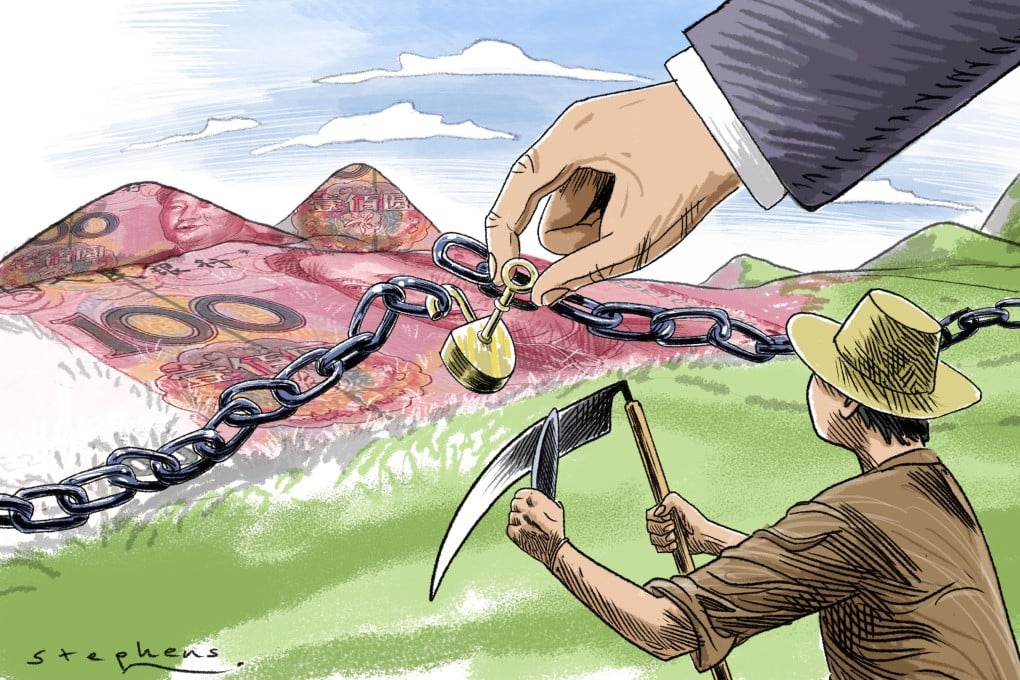

The People’s Bank of China has already signaled it will begin dialing back the pandemic stimulus used to funnel loans to small businesses in recent years. Local governments are also saddled with record amounts of debt, reducing their capacity to increase fiscal support.

“The People’s Bank of China could switch to a wait-and-see mode once the economy is back on track, and prepare for policy normalization,” said Yu Xiangrong, chief China economist of Citigroup Inc.

With local governments keen to “restore fiscal resilience,” there’s reduced chances for generous tax and fee cuts, an upward revision to the quota for special local bonds, or a further expansion in financing tools from state policy banks, he said.

The readout from the Politburo meeting will be closely analyzed for any changes in tone or language from the group’s gathering in December and the Central Economic Work Conference that may suggest a shift in major policies. There may not be a ton of specifics, though, as measures are usually fleshed out by government agencies following the meeting.

A more optimistic growth outlook

In December, China’s top leaders highlighted three major risks facing the economy: contracting demand, supply shocks and weakening expectations. The so-called “three layers of pressure” has been a catchphrase mentioned in several policy meetings since it first popped up in December 2021.

The PBOC removed the wording in its statement on its first-quarter monetary policy meeting, the first time the phrase was dropped at such events since late 2021. Recent comments from central bank Governor Yi Gang also suggest a more optimistic outlook for the economy.

China watchers will be assessing the language the Politburo uses to describe economic risks to gauge its confidence about the recovery.

Curbing record youth unemployment, boosting consumption

China’s fastest growth in a year in the first quarter was fueled by strong consumer spending, especially on services like travel and eating out, after pandemic restrictions were dropped. The government also front-loaded its infrastructure investment and the property market stabilized.

However, the recovery is fairly uneven. The job market remains subdued, with youth unemployment climbing to a near record high. Property investment continued to contract and the rebound in exports in March may be short-lived given declining foreign demand and heightened geopolitical tensions.

Sinolink Securities Co. said structural policies to address industrial, employment and consumption issues may be the focus “against the backdrop of diverging economic trends and the outstanding imbalances.” The Politburo may provide more guidance on industrial development as Beijing looks for ways to counter property weaknesses, economists including Zhao Wei wrote in a note on Monday.

Government agencies are busy studying specific measures to help the economy maintain momentum. The National Development and Reform Commission, China’s top economic-planning agency, is drafting policies to expand consumption, with boosting car sales one of its priorities. The Ministry of Commerce has said it will release guidelines to promote trade in each of the major overseas markets.

A pro-business stance with focus on boosting tech

Despite the pickup in growth, business confidence — particularly among private and foreign firms — has remained weak as profits continue to slump, China-US relations deteriorate further, and tech companies were left scarred by Beijing’s crackdown on the sector. Investment by the private sector rose merely 0.6% on year in the first quarter, its slowest pace in more than two years.

The Politburo will probably want to reassure investors that China remains open to foreign businesses, a stance it made clear at its December meeting.

In particular, officials will likely repeat a phrase to “‘unwaveringly’ support the private sector and open up further China’s economy to the outside world,” said Louis Kuijs, chief economist for Asia Pacific at S&P Global Ratings.

Recent visits and speeches by President Xi and Premier Li Qiang give hints about priority areas for investment, according to Sinolink Securities. On a trip to Guangdong earlier this month, Xi called for self-reliance in technology, while Li visited manufacturing firms in Hunan and tech unicorn startups in Beijing.

Xi renewed the tech push at a meeting last week, encouraging companies to break bottlenecks as Beijing mobilizes the private sector to counter what it sees as containment by the US and its allies. Barriers impeding fair competition should be removed to help private firms grow, he said, and policies should be calibrated to ensure better coordination and “solve companies’ real difficulties.” Kuijs said there was “only so much that China can do” to address decoupling concerns because “much of the action on that takes place in Washington DC.” Still, a sustained period of predictable policy-making in China, efforts to create a level playing field between state-owned enterprises, private and foreign firms, and more communication between senior officials and the private sector should help, he said.