Does the BRI Increase China’s Influence?

Beijing’s extensive infrastructure projects don’t seem to be translating into political clout.

Political leaders in the United States and other democratic nations have been expressing concern about growing Chinese “influence” around the world. In a 2022 speech at George Washington University in Washington, D.C., for example, U.S. Secretary of State Antony Blinken said: “China is a global power with extraordinary reach, influence, and ambition,” which has been using this power to alter the multilateral institutions and arrangements that have shaped the international system since the end of World War II. More recently, the former Australian Prime Minister Malcolm Turnbull, while introducing a new “foreign interference” law, called China “the most active state and political party seeking to influence public affairs in Australia.”

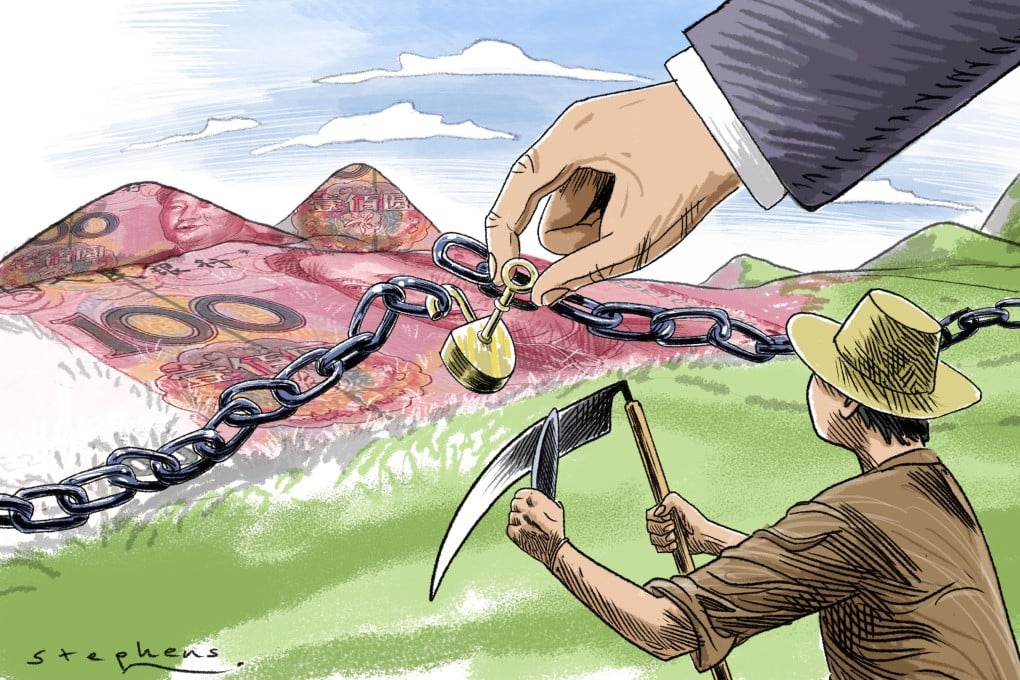

One key element in China’s influence campaigns is its substantial economic investments around the world—and especially its Belt and Road Initiative (BRI). Since its inception in 2013, the BRI has expanded to include infrastructure projects in almost 150 nations across Africa, Asia, Europe, and Latin America, and is estimated at $1 trillion. Observers claim that the BRI’s goals are twofold. First, China seeks to expand trade, especially as its domestic growth slackens. Second, through support for infrastructure projects, the Chinese government aims to bolster its soft power and exert political influence over recipient countries.

Though the effort appears to be paying off on the first goal—by some estimates, China’s exports to BRI recipients have doubled over the past decade and now total nearly $1 trillion—the other question remains: Is the BRI generating political influence for Beijing?

Our research suggests otherwise. How politicians talk about China is important—it presumably reflects some measure of population sentiment toward the Chinese government, and it likely shapes how constituents will want their government to engage with Beijing in the future. Judging by the public statements made by politicians running for and holding elected office in three Southeast Asian countries that are prime targets for Beijing (the Philippines, Malaysia, and Indonesia), we find no evidence for BRI-related influence.

The question of whether BRI is generating so-called influence requires first defining the term in a way we can measure it. If scholars are not careful, assertions about influence can quickly fall into exaggeration and hyperbole, leading to misguided policy formulation.

We suggest that Beijing is trying to build coalitions of actors (e.g., producers of raw materials that China consumes) within target states that share at least some of its goals and take actions that advance its interests. This refined form of influence is much closer to the concern that many Western policymakers have about Chinese investment activities.

Our research, supported by the U.S. Defense Department’s Minerva Research Initiative (which focuses on areas important to the U.S. national security strategy), addresses politicians’ public speech. This is because expressions of sentiment toward China can advance or hinder Beijing’s long-run interests (such as by making it easier or harder for politicians to take pro-China actions) and are readily observable (unlike backroom dealing). Efforts to influence political sentiment may thus be seen as an expression of Chinese soft power. We define a successful influence campaign as one that alters how politicians talk about China in a positive direction. That kind of influence can be measured, because in the modern world, politicians everywhere are constantly opining on social media on a wide range of topics, including China.

To be sure, this approach does not exhaust the entire universe of possible influence campaigns that China might use, including bribes, the establishment of language and cultural institutes, disinformation campaigns, and targeting Chinese expatriate communities. But bribes can backfire: Politicians may come and go; they may try to hold out for more graft; or their corruption may ultimately get uncovered, such as in the case of former Malaysian Prime Minister Najib Razak, who was tossed from office by angry voters following revelations of massive corruption, including from Beijing.

Existing studies suggest conflicting findings when it comes to the BRI’s growing influence. On the one hand, improved economic ties may be used to buy over elites on certain policy positions. For example, Pakistan was not among the 50 countries that joined in condemning the Chinese government’s activities in Xinjiang, at least partly due to Pakistan’s dependence on Chinese investment in that country.

Generous financial support and local job creation can also boost public support toward the foreign donor. According to the Afrobarometer surveys in 2019 and 2021, nearly 63 percent of the population in 34 African countries, including Mali, Sudan, and Tanzania, held positive opinions toward China; China’s investment and infrastructure projects in Africa were reported as among the most important factors that led to the positive attitudes.

On the other hand, China’s foreign aid and BRI projects have been found to increase the local perception of corruption in Sub-Saharan Africa—from the BRI-funded railway between Nairobi and the port of Mombasa in Kenya to the allegations surrounding telecommunications firm ZTE paying bribes to officials in Liberia and Benin. In Australia, China’s political donations and academic funding have generated popular resentment. China is also seen as a major contributor to “debt distress” in countries such as Sri Lanka and Zambia, creating negative political fallout. Perhaps not surprisingly, perceptions of China’s influence have faced a small drop in the Afrobarometer surveys since 2014.

We examined China’s investment and influence in the context of three Southeast Asian countries that are strategically important to both the United States and China, have BRI investments, and experience periodic foreign-policy shocks related to the South China Sea disputes—Indonesia, Malaysia, and the Philippines.

Indonesia has long defied Chinese territorial claims (the so-called nine-dash line) around the Natuna Islands, creating political friction with Beijing. Malaysia also has a maritime dispute with China around Luconia Shoals, where the nation’s state-owned Petronas oil company has been developing the Kasawari gas field. And the Philippines has had long-standing territorial disputes over the South China Sea with China, which refused to recognize international arbitration in favor of the Philippines in 2016. The presence of South China Sea disputes in these countries, alongside BRI projects, provides a unique opportunity to study the effectiveness of the initiative in shifting how politicians engage with China.

Specifically, we looked at how politicians reacted to foreign-policy disputes with China to see whether politicians in districts with substantial BRI spending responded differently than those whose districts have not benefited directly from Beijing’s largesse. If the BRI is winning influence, as we define it, then politicians serving or running for office in constituencies that received BRI projects should be less likely to express negative sentiment toward China after South China Sea disputes, compared to politicians in constituencies without BRI projects.

To see how politicians talk about these disputes, we collected all Twitter and Facebook activity from 2009-2021—the period for which there is data on BRI spending and one in which politicians in the region used social media heavily—for members of the national legislative bodies and a sample of losing candidates in Indonesia (1,018 politicians in total), Malaysia (720 politicians in total), and the Philippines (1,291 politicians in total). All told, these politicians wrote more than 100,000 messages on Twitter and more than 80,000 Facebook posts, each of which we scraped for political sentiment.

We first utilized Google’s Natural Language Processing API, an artificial intelligence language model, to calculate an overall sentiment score for each post, which it generates based on large amounts of text drawn from a diverse list of sources (ranging from movie reviews to legal documents). Second, we used a pre-classified dictionary that defines positive and negative words to score the posts again, providing an additional measurement.

As the examples below show, there are positive, neutral, and negative posts across constituencies with and without BRI investment.