The Forthcoming decline of China’s defence exports

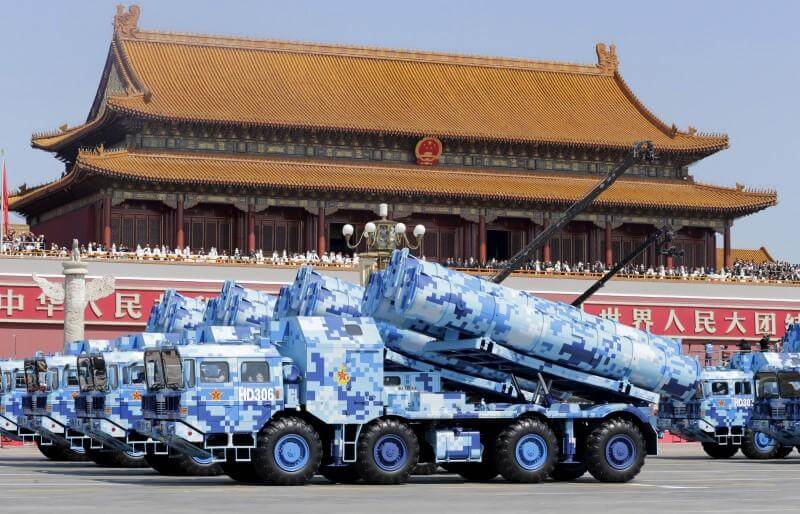

The Chinese defence industry, last year set a record high in terms of sales to partner countries. From defence export agreements with Pakistan, Nigeria, Kenya, Bangladesh and 40 others, China’s military exports has played a major role in its overall global economic dominance in the past few years. The total worth of Beijing’s military exports was estimated to be over USD 3 billion in 2022 alone, marginally raising from the year prior.

However, apart from the impression of being a new entrant in the market, Chinese equipments have so far failed the international standard set by its western counterparts. The lack of technological resilience has also left many importing countries with empty defence coffins, causing political uproar among domestic stakeholders. More so, China’s notorious play of providing such exports to non-state actors has resulted in serious concerns among decision-makers.

Beijing’s Ineffective Equipment trade among allies

The fact that Chinese manufactured defence equipment has not only resulted in defective equipment being supplied, but has also turned out to be fatal for many army personnel has subsequently led to calls for addressal of such concerns among its own allies. Pakistan for instance, which accounts for about 45% of the total value of Chinese defence exports in the past 10 years and whose defence trade with China, cumulatively, grew up to USD 2 billion in 2022, has time and again, publicly expressed its frustration in continuing its defence imports from Chinese firms. This has majorly been experienced due to various reasons. Firstly, Pakistan’s military raised serious concerns over the F-22P frigates that it had purchased from Beijing as part of a multi-million-dollar agreement. These ships were found to be ‘seriously flawed’ with their imaging device, infrared sensor system, and radars ineffective for ground utility. Moreover, the lack of efficient responses from Beijing’s side on repairing or replacing faulty equipment has also further added to Islamabad’s worries. Even in Myanmar, one of China’s trusted allies, is facing similar concerns. Many of the China’s JF-17 fighter jets the military junta imported in 2022 were ultimately unused for operations due to severe technical discrepancies. However, China’s Asian partners are barely the tip of the iceberg, the aggregated concern on similar matters is majorly faced within African countries that aimed to substitute China’s cheaper equipment for imports as compared to Western as well as Russian alternatives.

Chinese arms export in Africa

China’s overall focus on the African continent has not only been limited to its political and economic engagements in the continent, but has steadily over the past few years entered a security dynamic as well. Within the past decade itself, Beijing has become a prominent defence exporter in the African continent as a whole. Between the five-year period of 2013-2017, Chinese arms export increased up to an astonishing 17 percent of Africa’s overall defence imports from all over the world. China currently is a arms supplier to around 25 African countries making it the largest exporter of defence in terms of number of countries. African countries including Kenya, Nigeria, Tanzania, Zambia, Zimbabwe and many others have had to switch to becoming defence importer of Chinese origin due to cheaper bargain the Chinese were initially offering. However, a critical component of China’s defence export strategy seems to be falling; the quality concern of Chinese equipment has seriously impacted the credibility of Chinese defence firms in providing high-quality imports. Even though Beijing, in the past decade has been providing defence equipment at very competing and low-price rates, the effectiveness of its equipment is beginning to come under serious scrutiny among these countries. Prediction data from a prominent research institute, Janes, shows that the upcoming years are expected to take a heavy toll upon China’s defence exports, precisely due to these concerns that have been causing difficulties among importing countries. These forms of issues have also significantly impacted Beijing’s global market push for its homegrown defence sector, preventing its companies from penetrating into the North African and other markets. The low-quality and high quantity factor may have yielded Beijing some momentary highs in terms of its exports, but have essentially begun to fall through the cracks given the poor-quality standard its equipment has showcased. Thus, it would be wise for other importing countries to reconsider their trade with Beijing, especially in sensitive sectors such as defence; for China’s under-performing outputs are not only going to strain the importing countries defence budgets, but is also going to severely impact its potential to safeguard as well as defend its sovereign territories against external threats.