Beijing’s African Gambit Is Having Issues

Beijing has decided that it needs to make concessions within its Belt and Road Initiative (BRI) in Africa. The arrangements always aimed to give China ultimate dominance — in Africa and elsewhere along the BRI. The problem for Beijing is that the underlying plan is revealing itself a little too fast and a little too thoroughly to keep African states enthusiastic. China’s leaders simply cannot afford to let these African states see the tremendous disadvantages that are the ultimate end of the scheme, at least not yet.

China-Africa trade news has raised a red flag. Total trade between China and its African partners in the BRI – most notably South Africa, Angola, Nigeria, the Democratic Republic of Congo, and Egypt – increased last year only a modest 1.5% to the equivalent of $281.1 billion. Most of the growth came from a strong 7.5% surge in Chinese exports to these African countries. The dangers implicit in Beijing’s plans reveal themselves in the 6.7% drop in African exports to China. Africa’s trade deficit with China jumped 14% from $46.9 billion in 2022 to $64 billion last year.

Under conventional trade circumstances, these figures might not please the Africans, but against the backdrop of Beijing’s BRI, the news carries a deeper, more revealing meaning, and one that Beijing has little desire to see clarified.

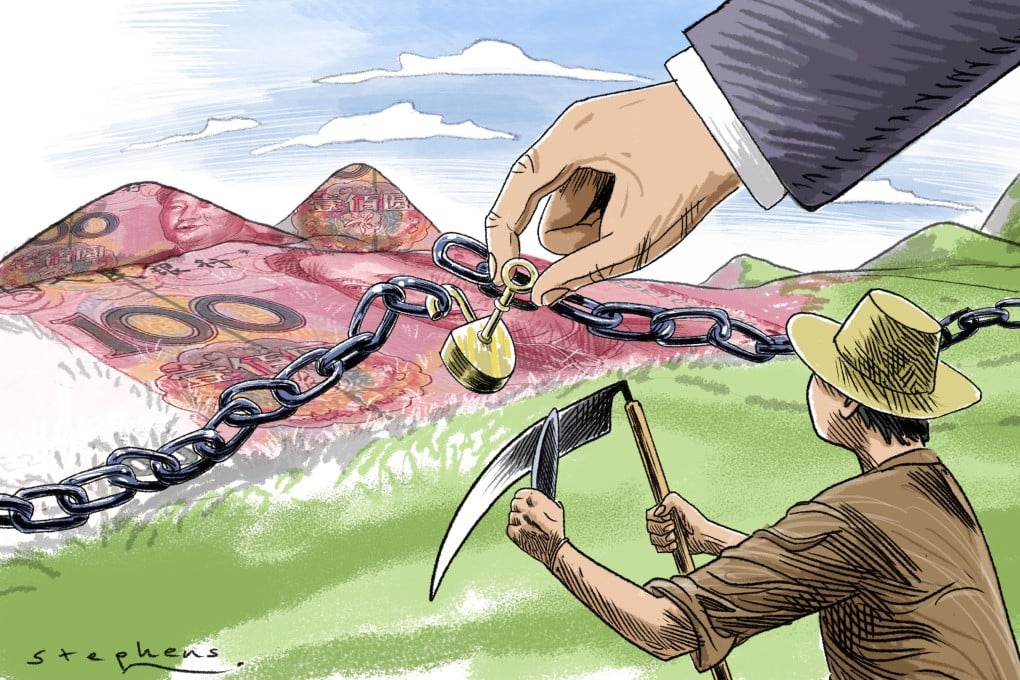

The BRI always only ever seemed like a good deal. It went beyond the conventional goals of raising China’s global profile diplomatic stature and far-reaching commercial interests. It was and is structured to give China dominance in the economies that become involved. In the scheme, China entices partners, typically in poorer countries, by offering to finance development projects and trade agreements. The BRI arranges loans from Chinese banks for the projects and engages Chinese contractors to do the work. When the projects are complete, say a port facility, Chinese managers run the operation. The host nation gets the debt, China gets the export business during construction and control afterwards. If the host country cannot meet the debt obligations, China gets ownership as well. China gathers still more advantage because many of the trade agreements are written in yuan.

Beijing targets partners either because of the diplomatic advantages they offer or because their economy has products, usually raw materials, that China needs for its own development. The Congo, for instance, has cobalt, something China needs for its production of electric vehicles (EVs). Indeed, the Congo supplies some 60 percent of China’s cobalt needs. Nigeria and Angola have oil. South Africa has minerals, but the link also has great diplomatic advantages from Beijing, as does the link with Egypt.

But Beijing’s partners in the BRI – whether in Africa or elsewhere — seldom see their exports keep up with the import demands of the development projects, putting these countries into a trade deficit right from the start. Effectively, these client states find themselves living off credit in a situation where their ability to repay is dubious at best. This circumstance is why many involved with the BRI refer to it as a “debt trap” that will leave them dependent on and dominated by China. Pakistan, one of the earliest and biggest users of BRI arrangements, has fallen so deeply into debt that it has had to turn to the International Monetary Fund (IMF) and the World Bank for loans to help it deal with its obligations to Chinese banks. Sri Lanka has run into similar trouble, though on a smaller scale than Pakistan. No doubt, Italy withdrew from the BRI at least in part because of such prospects.

These African countries, newer to the initiative, had not yet reached the extremes of these other, now hard-pressed nations, but circumstances in 2023 conspired to point out to them where the BRI was likely to lead. For one, China’s economic headwinds – falling exports to the rich nations of the world, its property crisis, a related drop in consumer confidence and investment activity by its private businesses – slowed the economy’s pace of growth and accordingly reduced its imports of raw materials dramatically. China trade globally fell some 5%. China’s commitment to Russia also forced it to take more from Russia and accordingly less from its BRI partners. All this highlighted the disadvantages that the arrangements would ultimately put these African economies.

A drop in commodity prices in 2023 compounded problems for African economies and drove home the dangers of the BRI in yet another way. The price of a barrel of oil fell 18% from $101 in 2022 to $83 in 2023. Cobalt, critically important to the Democratic Republic of Congo, saw its price drop from $63,739 a metric ton in 2022 to less than $55,000 last year, almost a 15% drop. Other metals, such as copper and aluminum, also saw their prices fall. These price slides had nothing to do with the BRI, but they highlighted – in stark terms, too – how dependent these client economies had become on China and how quickly circumstances could put these materials exporters in straitened circumstances.

Rather than leave the African clients to realize the danger and pull away, Beijing has made efforts to ameliorate the strain on them, and no doubt also obscure the ultimate reality of the BRI. It has opened what it calls “green lanes” that allow more African agricultural products into China duty free. Beyond this, Chinese President Xi Jinping has promised his African BRI partners efforts to help them produce more agricultural products and develop operations to process them locally. Of course, this would only enlarge the amount of China-linked debt burdening these countries and, as in all BRI arrangements, benefit Chinese contractors. In the interim, however, the Africans can enjoy a credit palliative from the immediate strains.

Perhaps Beijing’s recent efforts to relive the strain on its African partners will satisfy them. They seem ready to cooperate. Ultimately, however, the BRI’s burdens will become apparent, as they have for Sri Lanka, for example, Italy, and Pakistan, though the last is unwilling to admit it. Then Beijing will either have to abandon the effort or make fundamental adjustments that go beyond a few food processing plants.