China’s Counter-espionage Law Raises Concerns For Foreign Consultants And Investment

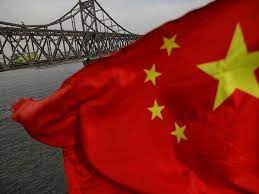

China’s new counter-espionage law, passed in March 2023, has broadened the definition of espionage, leading to increased risks for foreign consultants operating in the country. This development has raised concerns among experts who believe it may also discourage foreign investment. Recent raids on American due diligence companies, including Mintz Group and Bain & Company, as well as the questioning of employees at Capvision, have further fueled speculation regarding the consultancies’ approach to obtaining data and information, which China views as a violation of its counter-espionage law.

Despite the implementation of the counter-espionage law, Chinese Premier Li Qiang reiterated China’s commitment to opening up to the outside world at the China Development Forum (CDF) in Beijing. Li emphasized that China would remain steadfast in its open policy, regardless of changes in the international landscape. Additionally, China’s Commerce Minister, Wang Wentao, reassured world business leaders at the CDF that foreign businesses are considered “family” rather than guests.

Experts point out that the new counter-espionage law reflects Chinese Communist Party (CCP) head Xi Jinping’s increased focus on security. ChiouJiunn-Rong, a professor at Taiwan’s National Central University, suggests that Xi has trust issues and fears that Western countries may treat China as it has treated them in the past. Consequently, Xi seeks to protect China’s economic security by limiting the involvement of Western professionals in sensitive operations, such as accounting and auditing, for Chinese companies.

The revised counter-espionage law grants Chinese authorities broad powers, including access to data, electronic equipment, and personal property, as well as the authority to ban border crossings. However, critics argue that the law’s definition of “national interests” and “security” is vague, lacking clear boundaries.

The law broadens the definition of espionage, leading to arbitrary interpretations that can hinder foreign consultants’ operations and pose risks for foreigners in China.

Foreign companies engaging in business services, such as due diligence work, are particularly affected by the new counter-espionage law. Due diligence is crucial for foreign investors, especially in opaque authoritarian states like China. The surprise inspections on due diligence firms threaten the ability of foreign companies to conduct investigations and audits, hindering their investment capabilities. As a result, concerns grow that foreign companies may face increasing difficulties in accessing critical information necessary for their operations. This move will ruin china’s credibility in the global market. When regulators are targeted, their credibility gets affected. No one believes what the CCP tries to propagate anyways. This could be a very big mistake on China’s part.

Economists warn that the implementation of the counter-espionage law may backfire on China’s economy. Foreign-invested enterprises have played a significant role in China’s exports in recent years. With foreign investment becoming more hesitant due to stringent regulations, there is a risk of losing foreign support, leading to a decline in exports, investments, and employment. Furthermore, China’s disconnection from the Western world in areas such as technology acquisition, talent development, and global standards could hamper its economic growth and isolate it on the global stage.

China’s assertiveness on the global stage has raised concerns among the United States and its allies. Risk mitigation measures, including intellectual property protection, human rights, compliance, and tackling industry monopolies, are now essential conditions for cooperation with China. Such measures are likely to have a significant impact on China’s export business in the coming years. The new counter- espionage law is likely to have a significant impact on foreign investment in China.

The law makes it more difficult for foreign companies to access the information they need to do their due diligence, and it increases the risk of being accused of espionage. This is likely to lead to a decline in foreign investment in China.

A decline in foreign investment would have a negative impact on China’s economy. Foreign investment is a major driver of China’s economic growth, and a decline in foreign investment could lead to job losses and a slowdown in economic growth. China’s new counter-espionage law, with its broad definition of espionage, has increased risks for foreign consultants and raised concerns about investing in the country. The new counter-espionage law is a sign of the growing assertiveness of the Chinese government. The Chinese government is increasingly willing to use its power to crack down on dissent and control information. This is a trend that is likely to continue, and it will have a significant impact on foreign investment in China.